Do Awards Shows Still Matter?

If fewer and fewer people watch the show, what’s the point?

👋🏼 from Miami. I’m giving the opening keynote at CineLatAm today. If you’re around, say hi.

Once upon a time, awards night was an appointment: viewing parties, outfits, a fixture on the calendar.

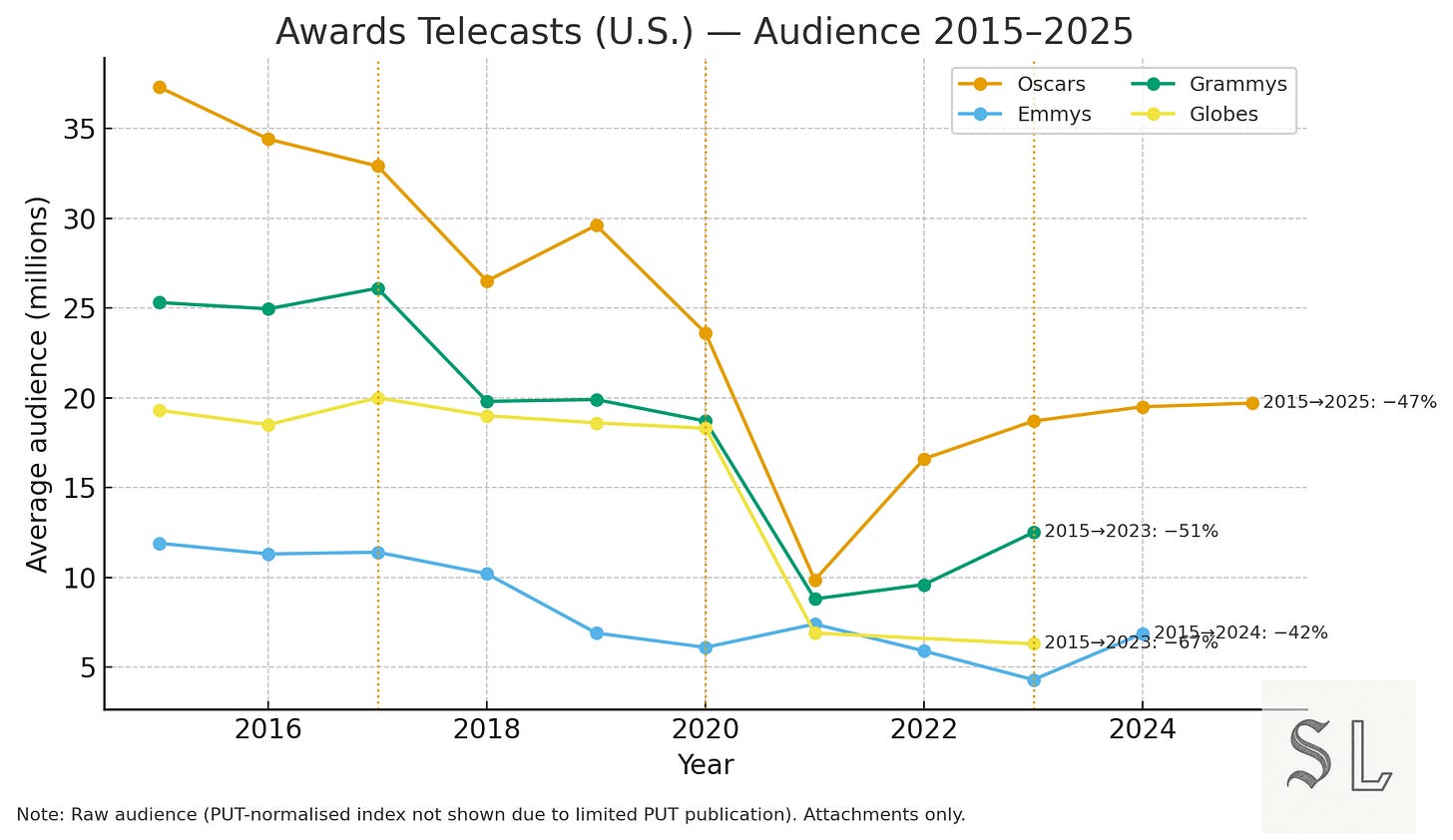

Today, the numbers are down across the big four U.S. telecasts (Oscars, Emmys, Globes, Grammys). That isn’t simply “audiences lost interest” or just the long decline of linear TV. The picture is more complicated (and more useful) than one answer.

Alongside that long slide, recovery since Covid has been uneven across shows.

So the questions we’ll answer are simple:

If fewer people watch the show, what’s the point?

Can we value nominations versus wins in a way that stands up to scrutiny?

Does everyone benefit equally, or do certain titles capture most of the upside?

What changed post-Covid that should change how we operate?

Which nominations convert into viewing and which hold less power?

We’ll organise the below around the three main jobs awards are meant to deliver:

Discovery: do nominations create more watching in the four weeks after the shortlist?

Catalogue: does that spike spill into older seasons and (for ad-supported tiers) better monetisation and pricing confidence?

B2B signal: does the nomination actually change packaging and commissioning decisions?

To justify even talking about this, we’ll start with two exhibits up front. From there, we land on five clear conclusions.

🔐 Paid subscribers get those answers + these 🔐:

2025 Emmys: Where We Would Spent, Where We Would Have Capped: The mid-scale nominees that would have moved in the nomination window, and those we would have capped.

What do we actually do the week after nominations? (Operator Playbook: step-by-step, Monday→Monday.)

Did nominations change behaviour, and by how much? (+4-Week Lift Test: baseline −4..−1, Incremental Minutes (0–28d), read +1..+4.)

Do we keep spending or stop? (Efficiency hurdles with IMp$ / SCp$; GO/STOP gate.)

Which titles deserve incremental FYC? (Allocation rules: prioritise mid-scale discovery; test megahits, don’t assume.)

How do we turn a spike into durable value? (Catalogue checklist for days 14–28: seasons surfaced, rows, AVOD tests, licensing prompts.)

How do we brief the room fast and defensibly? (Chart pack: Telecast decline, Noms→Minutes, Decision Gate, Recovery, Pre- vs Post-2020, YoY heatmap.)

How do we answer the standard objections? (Sceptic’s Corner: wins vs noms, megahits, attribution, catalogue claims.)

How do we keep this audit-proof? (Methods & Limits card: sources, definitions, exclusions, falsifiers.)

Can everyone speak the same language? (Glossary: Incremental Minutes, IMp$/SCp$/CAE, PUT/THI.)

Let’s begin.

Exhibit A: A decade of Awards Show telecast decline (U.S.)

The numbers

Oscars: −47% (2015→2025); trough in 2021, partial rebound since.

Emmys: −42% (2015→2024); record-low Jan 2024 (strike-delayed), rebound later in 2024.

Grammys: −51% (2015→2023); sharp 2021 trough, partial recovery.

Globes: −67% (2015→2023); further disruption from non-telecast years.

How to read this

These are raw TV audiences. We’re not normalising for PUT (People Using Television), which isn’t consistently published by slot.

Translation: a meaningful chunk of the slide is secular linear TV decline, not just awards fatigue.

Recovery is uneven: some franchises have clawed back ground; others are still near their lows.

Why it matters

Treat this as context, not the KPI. The broadcast number is shrinking; the business question is whether nominations convert into viewing in the next four weeks.

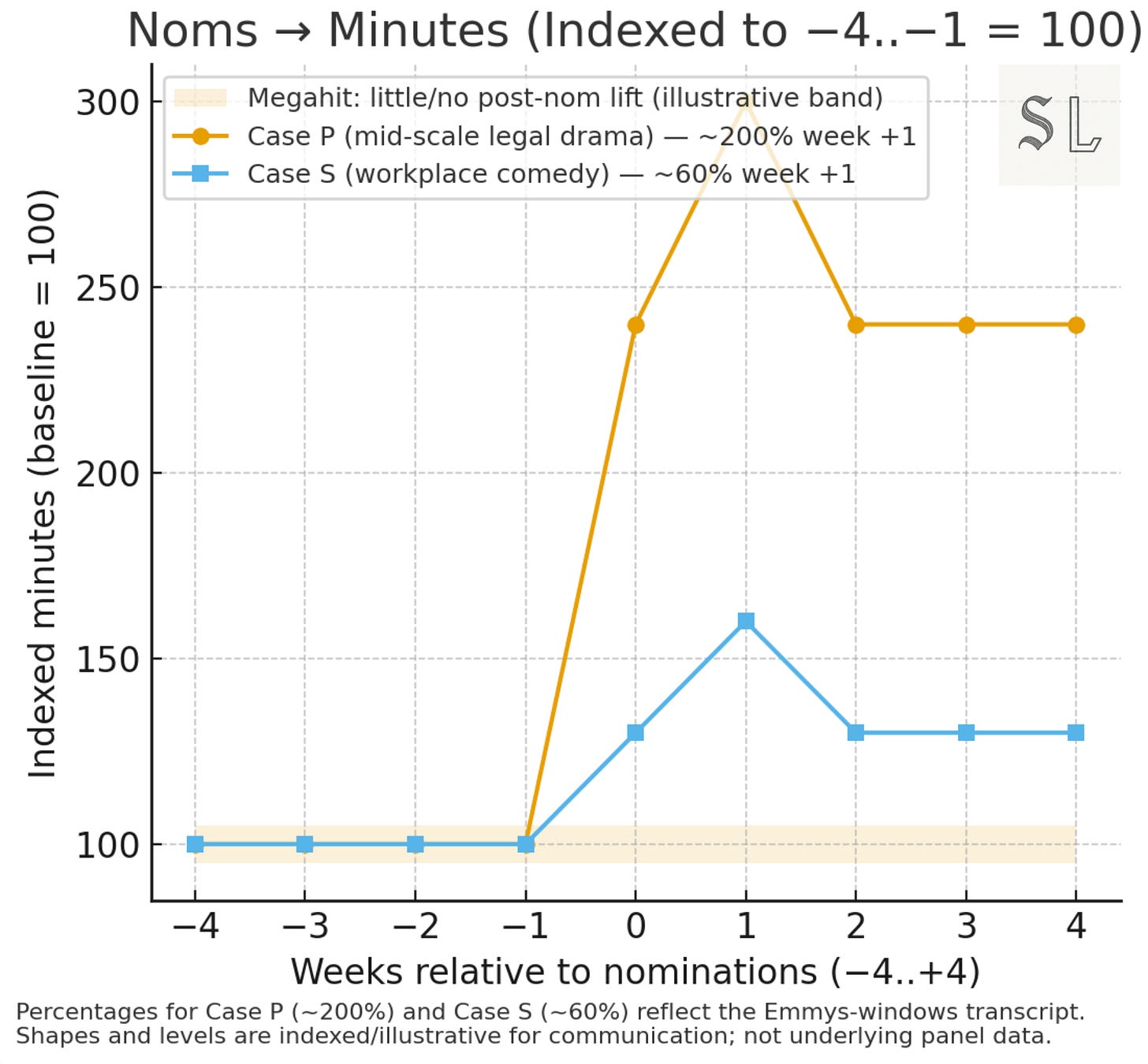

Exhibit B: Nominations → Minutes (weeks −4..+4)

The real action happens after nominations. If a title with room to grow spikes in week +1, it usually keeps some of that lift across the next few weeks. Megahits rarely move.

What you’re seeing

Minutes are indexed to 100 using the pre-nom average (weeks −4..−1), so very different shows can sit on the same chart.

Case P (mid-scale legal drama): ~200% jump in week +1, then stays elevated through +4.

Case S (workplace comedy): ~60% jump in week +1, smaller but still above baseline afterward.

The pale band is a megahit benchmark — titles that show little or no post-nom lift.

Read it in 10 seconds

The KPI is Incremental Minutes (0–28 days): how much viewing you gained across weeks +1..+4 versus the −4..−1 baseline.

Discovery titles (with headroom) tend to spike; megahits tend not to.

Week-one lifts (~200% / ~60%) come from research evidence the indexed lines show the familiar “jump then hold” pattern we see around nominations.

From these two exhibits, five conclusions follow

Nominations are the lever; wins are optional. The measurable action sits in the four weeks after nominations.

The telecast is context, not the KPI. Manage to Incremental Minutes (0–28 days), not the overnight.

Lift is concentrated. Mid-scale discovery titles jump; megahits rarely do. Allocate via a +4-week lift test and IMp$ / SCp$ hurdles.

Bank the spike. Convert nomination-week lift into catalogue value (old-season minutes, AVOD performance, pricing confidence) or it fades.

The credential still moves decisions. Track the B2B signal: attach-rate deltas (0–90d), pilot→series conversion, and slate-level nomination density.

1. Nominations are the operating lever; wins are optional.

The repeatable value sits in the four weeks after nominations. Wins help if they come, but you shouldn’t plan on them.

If awards still matter anywhere, it’s in the month after nominations. That’s the window when curiosity turns into behaviour. A shortlist drops and a title stops being just another tile: the press runs clips, platforms surface rows, friends post the trailer they ignored in September. The badge lowers the risk of trying something new. If a show is going to move, you see it quickly—first in the week after nominations, then in whether that bump holds through the next three.

2. Telecast ratings ≠ business value.

The Sunday number is a headline, not a P&L.

Over the past decade, average U.S. audiences for the big four have fallen sharply (Oscars −47%, Emmys −42%, Grammys −51%, Globes −67%) and a good slice of that slide is simply fewer people watching linear TV at all. A smaller telecast does not tell you whether the awards worked for your titles, simply about the distribution reach.

The business question is different: did nominations change viewing behaviour in the month that follows? That’s what you can influence with placement, comms and product decisions.

3. ROI concentrates in mid-scale discovery; megahits show low marginal lift.

The spikes that matter aren’t where you might expect.

The biggest post-nomination jumps in our research come from mid-scale discovery titles (shows with headroom and a curious audience that hasn’t yet sampled them). The ~200% and ~60% week-one lifts sit in that bracket. By contrast, megahits like The White Lotus or The Last of Us show little or no nomination-week bump once a season has finished; they’re already saturated. In plain terms: awards widen the doorway, and that helps most when lots of people are still standing outside.

For readers outside the industry: “mid-scale discovery” means well-reviewed series that aren’t yet ubiquitous; “megahits” are the handful of shows everyone already knows. Awards help the former more than the latter because the nomination lowers the perceived risk of trying something new.

4. Convert the spike into durable value or it evaporates.

A nomination-week bump is momentum, not money.

If you don’t give it somewhere to go, it fades. When a title lifts in the month after nominations, the next question is simple: does that curiosity travel into the library? In practice that means more starts on earlier seasons, more completions, and a visible uptick on the rows where nominees sit.

Think of it as routing: the shortlist lowers the risk of trying one episode; the product has to make the rest easy. When platforms surface all seasons, keep nominee shelves in obvious places, and remove small bits of friction (the nudge to continue, the next-episode prompt, the “start from season one” tile), the spike can become a habit. On ad-supported tiers, you should also see the effect in how well back-catalogue episodes monetise. In rights markets, a sustained run of viewing gives you confidence at renewal.

For non-industry readers: “catalogue” simply means everything beyond the current episode (past seasons, related titles, the long tail). The economic win is turning a short burst of attention into steady library consumption.

5. Awards still matter in B2B decisions; measure it like a process, not a myth.

Awards matter long before a viewer turns on the TV.

Inside the business, a nomination acts as a credential: emails get answered, meetings appear, packages come together faster. Boards also use nominations as a quality shorthand when ranking slates; they look at how often and how consistently a company’s titles are recognised.

For non-industry readers: “packaging” is assembling the team that makes a project real (the writers, directors, cast, financing). An “attach rate” is simply how often the people you ask say yes. If nominations truly help, you should see a short, clear bump in those yeses, and in how quickly projects move in the weeks after the shortlist.

🔐 Operator’s Playbook

What to do now (Monday → Monday)

How do we turn “awards week” from a vibe into an operating plan we can run, measure, and defend?