The 2026 Strange Loop Survey Results: You all are grumpy

Low Trust, Institutional Doom, Toolchain Optimism

As you might recall, I ran an anonymous survey across Strange Loop readers. Respondents were culture operators in 35 countries largely across film, TV, streaming, video games, sports and live entertainment. 92% of them were aged 35–54. And, interestingly, 75% were in orgs with 200+ people (so let’s assume leaning towards the larger players in each vertical), and within their orgs, 42% are in the C-suite (incl. founders), 33% consider themselves mid-career, 17% are in late-career, and the remaining 8% are early-career. As expected, responses are most heavily weighted across US, UK and EU (but all major territories are represented).

Gotta say, it was pretty revealing:

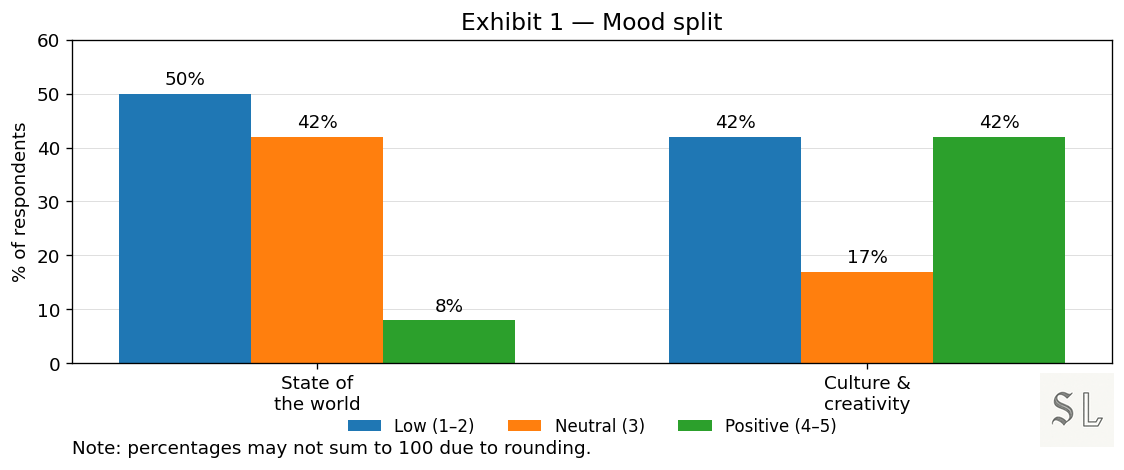

People feel bleak about the world.

They feel mixed about culture.

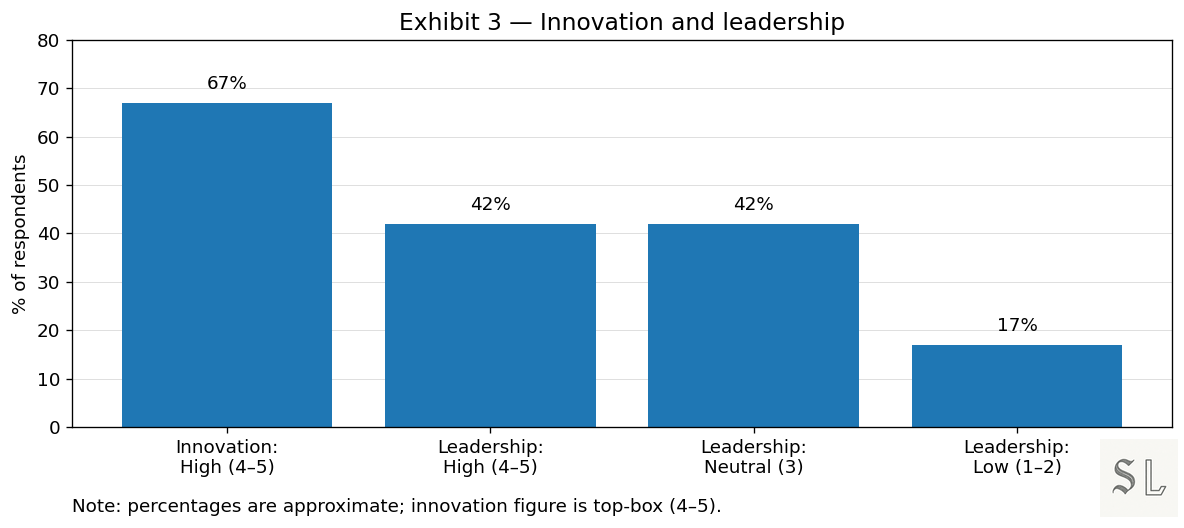

They feel remarkably confident that innovation will keep accelerating.

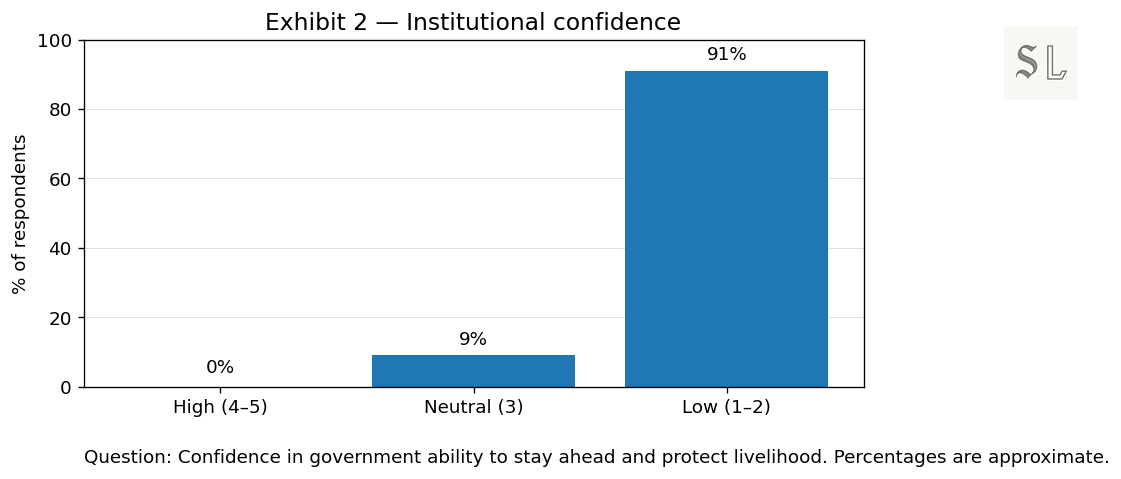

And they have almost no faith that institutions or their leadership will protect them while it happens.

The Top 7 Themes

1. The world feels bad. Culture is a coin flip.

There’s a particular kind of psychological strain that comes from being professionally responsible for “culture” while personally feeling the world is sliding.

Thankfully, we’re not in “culture is dead” consensus, but we are in split-screen reality.

Half the room is reading 2026 as creative contraction: risk-off budgets, safer formats, narrower taste. The other half is reading it as creative expansion: cheaper tools, faster iteration, new distribution, more permission to experiment. Same inputs, but two incompatible conclusions.

This matters because it changes what you fund, what you greenlight, who you hire, and how you measure success. When a leadership team can’t agree whether the moment is a winter or a spring, strategy turns into parallel play: one side builds for defence, the other builds for growth.

The headline isn’t “culture is collapsing” but “the industry has lost a shared map”.

2) Government is not in the chat.

This is the most uniform signal in the entire survey: a near-total collapse of confidence in public institutions to protect livelihoods in the year ahead.

Whatever your politics, this is a collapse in institutional confidence, not a partisan preference. When ~91% are at the low end and 0% at the high end, the practical belief is simple: no one is coming to stabilise this for you.

That changes how people behave inside culture organisations. You stop planning around policy support, safety nets, or “the system catching up”. You plan around internal resilience: skills, tooling, and repeatable operating models.

3) Innovation is scored high, even when faith is low.

Here’s the paradox: if the world mood is down and institutional trust is gone, you’d expect innovation confidence to fall too. But, it doesn’t.

So people don’t feel wildly inspired by leadership, but they do feel the sector is innovating.

That’s likely because “innovation” is no longer something leadership creates so much as something leadership is forced to absorb. The toolchain is advancing outside the org chart: vendors ship new capabilities weekly, open-source collapses technical barriers, and competitors normalise new baselines fast. Even if your leadership is cautious, the environment doesn’t let you stand still.

So the signal seems to not be “we trust the people in charge” but instead “we can’t avoid the upgrade cycle”. The question for 2026 becomes: can your organisation convert that forced acceleration into coherent strategy, or does it just accumulate tools without changing outcomes?

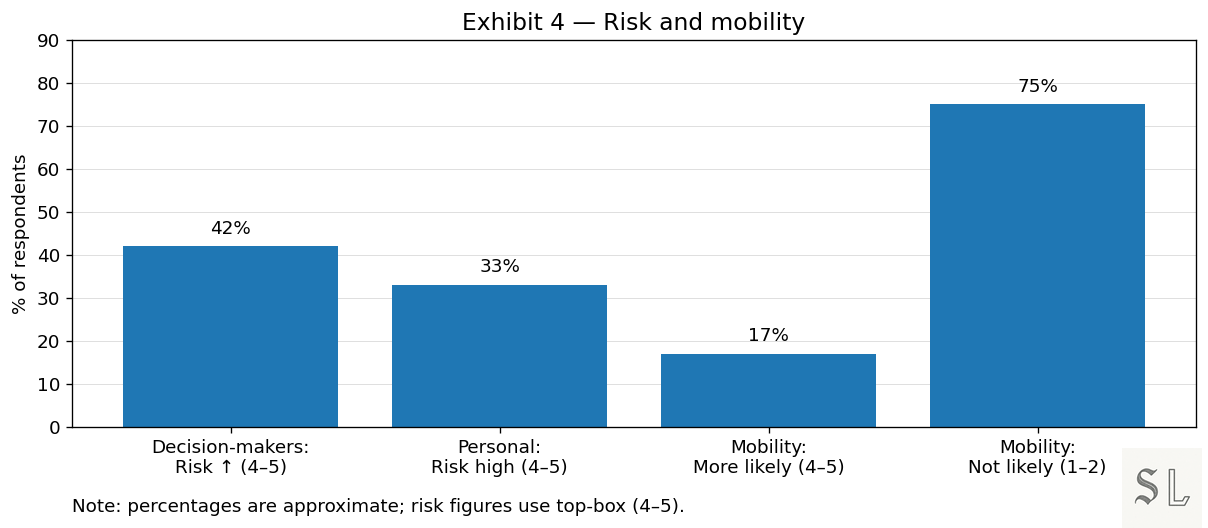

4) Risk appetite is rising, but nobody is leaving their job.

There’s a difference between “risk appetite” as a strategic posture and risk appetite as a lived reality. We have a big gap here, too.

This is what a risk-on narrative looks like in a risk-off labour market.

Boards and senior decision-makers may be signalling more appetite for bolder bets (~42% top-box). Individuals are less convinced (~33%), and almost nobody is behaving like it’s a boom cycle when it comes to mobility: only ~17% say they’re more likely to move, while 75% are explicitly not.

So the energy isn’t “jump ship and reinvent” and seems to squarely sit with “adapt in place”. People are willing to take calculated swings inside the role (process change, tool adoption, portfolio reshaping) but they’re avoiding personal resets without a guaranteed landing.

Said another way: 2026 is being modelled as a volatility cycle.

5) The threats are economy first, consumer behaviour second, tech as accelerant.

When asked what will most shape their sector, respondents couldn’t decide on a single villain.

Operators are modelling 2026 as an economy + demand problem first.

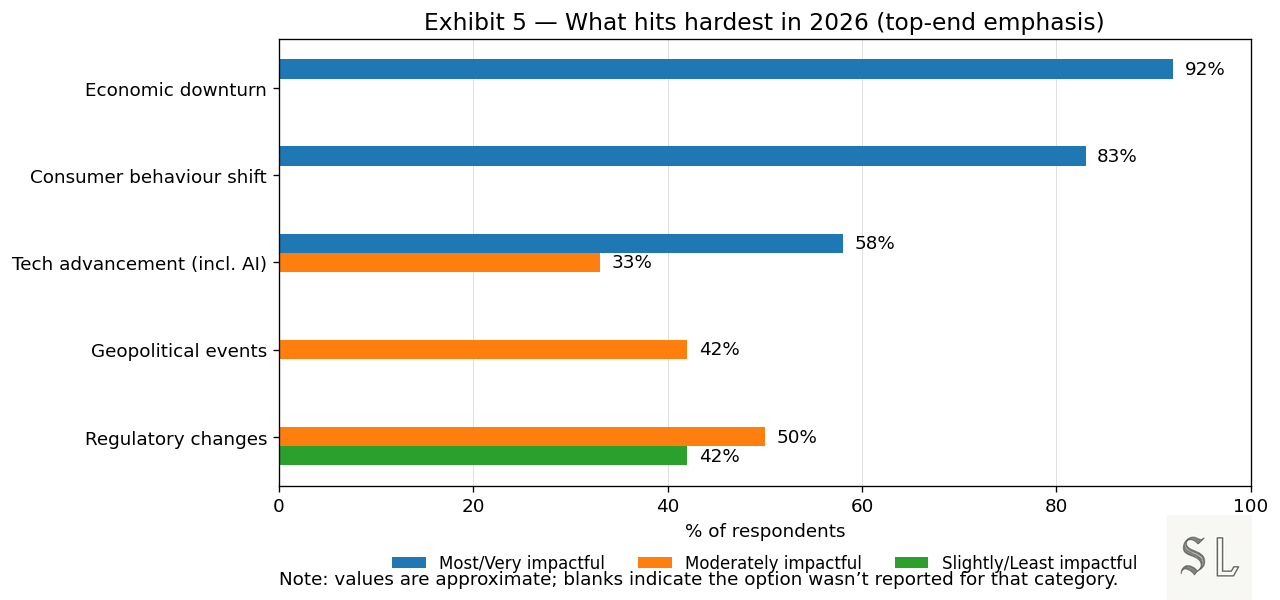

Economic downturn (~92% top-end) and consumer behaviour shifts (~83% top-end) are read as the primary forces shaping outcomes: spend tightens, audiences fragment, conversion gets harder, and “hit rate” becomes a survival metric.

Tech (incl. AI) is significant (~58% top-end; ~33% moderate), but it’s not framed as the root cause. It’s framed as an accelerant: it compresses timelines, lowers production costs, increases competitive pressure, and makes every margin and demand shock arrive faster.

Geopolitics and regulation sit in the mid-band for most people; not irrelevant, but not the day-to-day governor of decisions. They’re treated as contextual volatility rather than the main engine.

If you’re planning 2026 as a “tech transformation” story, you’re likely misreading the operating reality. Most teams are planning for demand fragility and margin pressure, with technology as the tool you use to survive that environment, not the storyline that replaces it.

6) AI is both overhyped and underrated, which is exactly what it feels like to live inside a transition.

The qualitative answers have an almost comic symmetry:

“Overhyped: AI as a catch-all solution”

“Underrated: the places where it actually changes workflows”

“Overhyped: AI replacing jobs”

“Underrated: AI supporting jobs”

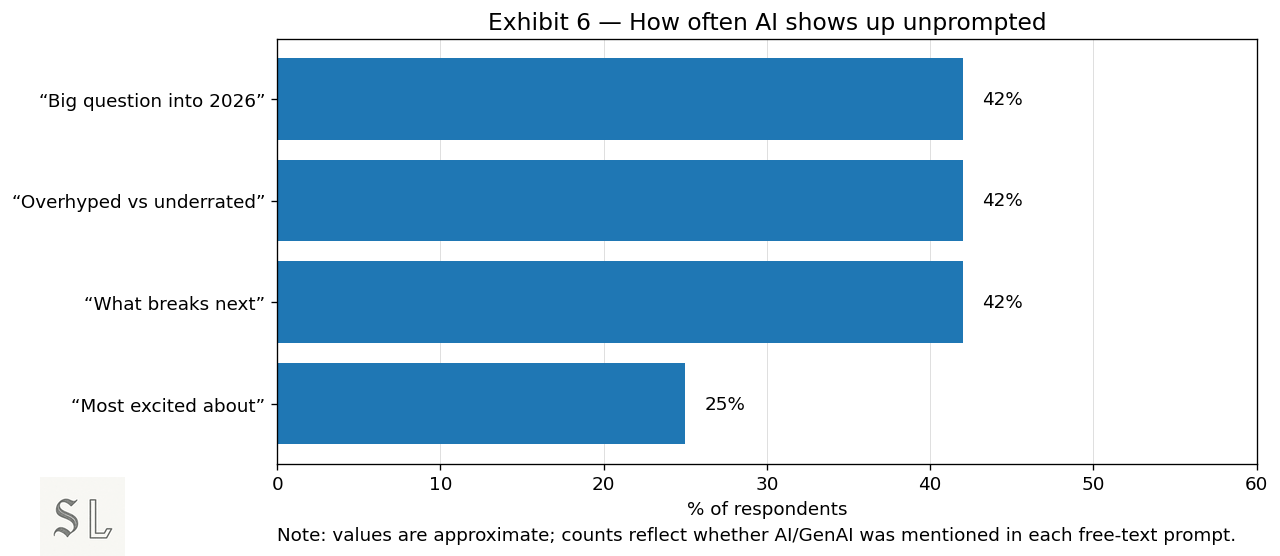

AI is the default language of uncertainty right now. It shows up unprompted in the “big question”, “overhyped vs underrated”, and “what breaks next” prompts at roughly the same rate (~42% each). AI has become the ambient variable that everyone assumes is in the room, even when the question isn’t “about AI”.

But the emotional tell is the drop when you ask what people are excited about: only 25% put AI there. In other words: AI is where people locate risk and disruption more than joy. Excitement is more distributed: creators, new formats, premium experiences, and operational optimisation; all places where humans still get to feel taste, craft, and momentum.

And when people say “what breaks next”, the failure modes are specific weak points in the stack:

Discovery: search and recommendation shifting towards AI-native answers and interfaces (legacy dominance erodes).

Feeds: social spaces degrading into synthetic sludge (signal-to-noise collapse).

Measurement: tracking/attribution models failing as platforms and interfaces change (decision-making loses its instruments).

Economics: content models breaking under cost pressure and overpricing (margin + demand mismatch).

Labour: creative labour tensions rising as capability scales (roles redefined faster than organisations can metabolise).

So even if respondents disagree on which layer fails first, the shared diagnosis is: the stack is brittle. AI isn’t just a tool in this context, but the stress test that reveals where the system was already weak.

7) The long-term bet is personalisation plus creators, with ethics as the friction layer.

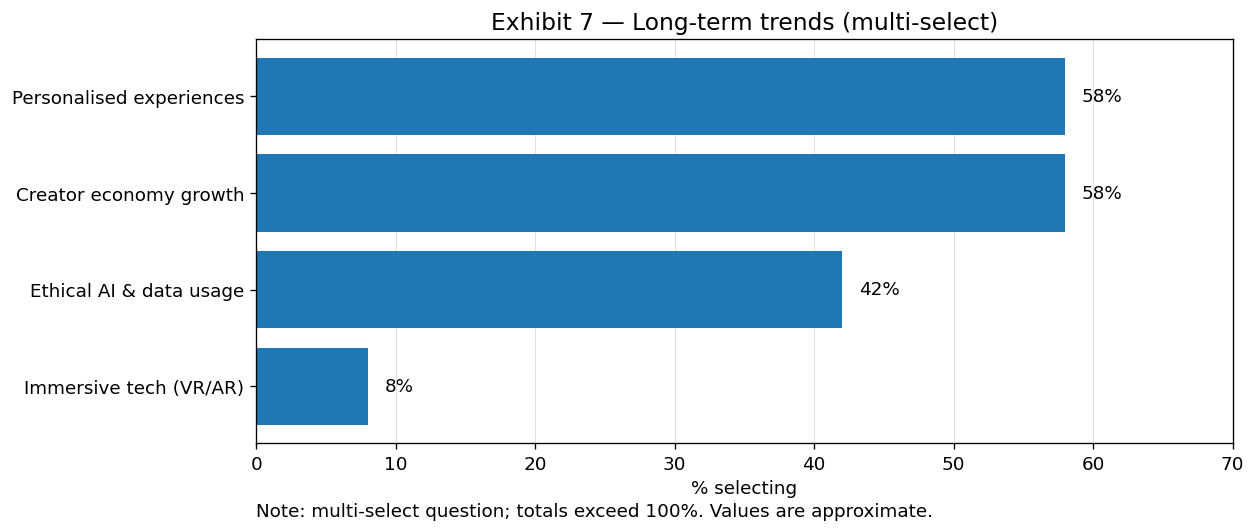

If you zoom out from “what hurts in 2026” to “what matters long-term”, the answers converge.

The long-term bet here isn’t “more content” (I think we’ve all learnt that lesson the hard way). Instead, the industry sees concerns around the reshaping of the whole value chain.

Distribution is being rebuilt around the individual (~58%): not just more targeting, but interfaces and experiences that adapt to the person, whether in context, intent, taste, and timing.

Production is being rebuilt around creators (~58%): creators aren’t a marketing channel anymore; they’re a parallel production and distribution system with its own economics and norms.

Legitimacy is being rebuilt around ethics and data practice (~42%): as content becomes cheaper to generate and harder to trust, provenance and responsible data use become competitive advantage, not compliance.

The sub-signal matters: one respondent frames personalisation explicitly as something that can restore community and belonging. (That’s the Strange Loop punchline: personalisation, pushed to its limit, becomes isolation; a perfectly tailored world with nobody else in it.) The corrective isn’t de-personalisation but personalisation that rebuilds shared meaning: products and platforms that use personal relevance to route people back into communities, not further into private algorithmic rooms.

What I’m Taking from It

2026 isn’t a “culture is dead” year. It’s a “we’ve lost the map” year. The headline signal is fragmentation: on mood, on creativity, on what’s broken, and on what counts as progress. When the shared narrative collapses, strategy becomes harder than execution, because teams aren’t even optimising for the same future.

Institutional trust has failed, so technology becomes the default coping mechanism. Not because everyone loves AI, but because almost nobody believes governance will keep pace. In that environment, tools stop being a trend and start being infrastructure: the only lever people feel they can pull to protect productivity and margins.

Innovation is still scored high because it’s no longer optional. The upgrade cycle is external to leadership. Vendors ship, competitors normalise new baselines, costs fall, expectations rise. You can be sceptical and still be forced to adopt. That’s why “innovation confidence” stays elevated even when “leadership confidence” is mixed.

Risk is moving up the org chart, but not into people’s lives. Boards want bolder moves; individuals are behaving like it’s a volatility cycle. The dominant strategy is adaptation in place, not mass mobility. That’s a constraint on reinvention: lots of internal change, fewer clean-slate resets.

Operators see the year as an economy-and-demand problem first, with tech as the accelerant. Economic pressure and consumer behaviour shifts are read as the primary drivers. AI matters, but it’s treated as the force that compresses timelines and amplifies everything else, not the root cause of the pain.

AI is the dominant anxiety, not the dominant joy. It shows up unprompted as the uncertainty variable, the disruption narrative, and the “what breaks next” lens. But excitement is more distributed. People are still looking for human-shaped upside: creators, formats, premium experiences, and better operations.

The long-term direction is clear: individualised distribution, creator-led production, ethics-led legitimacy. The future isn’t volume. It’s relevance, trust, and a reorganisation of who gets to make, distribute, and monetise culture.

If I had to compress it into one line: we’re moving into a period where acceleration is guaranteed, but coherence is not. The winners won’t be the loudest AI evangelists or the most theatrical doomers. They’ll be the operators who can build a shared map: a clear theory of demand, trust, measurement, and creator economics, and make their teams act like they’re in the same world.