The Monday Briefing: How Sphere, ABBA & Netflix Are Rewriting Live Entertainment

How Sphere, ABBA Voyage and Netflix House turn catalogue IP into perennial, automated attractions, and why it will spread.

By Reader Demand, meet The Monday Briefing

Every Monday: one fast, data-driven breakdown of the biggest shift in culture. We’ll cover:

the mechanics,

the why, and

what to do about it.

Quick enough to scan, sharp enough to brief a boardroom. Subscribers get the full crib sheet each week: quantified KPIs, breakeven maths, deal templates, refresh cadences, early-warning signals, governance guardrails, and falsifiers.

We’re opening with a big one

How Sphere, ABBA Voyage, and Netflix House turn catalogue IP into perennial, automated attractions, and why this model is about to scale everywhere.

Got a topic you want covered or tip to share?

In Short (for the impatient)

What’s emerging is not the end of cinema or concerts, but an operating inversion. Culture used to scale by moving artists to audiences. Now it scales by moving audiences to owned screens and by capturing artists once so the “show” can run forever. The value is in venue control + IP control + automation discipline. Audiences, for their part, are telling us the quiet truth: if the place is special and the format is transcendent, fidelity can bend. Within the incredibly fraught business environment of live entertainment, cinema, and music, these three examples point to a new business model entirely.

Today We’re Talking About

Follow the money: high‑CapEx venues that own the screen + licensed or owned catalogue IP = fat recurring yields with minimal marginal labour. Sphere (cinema as attraction), ABBA Voyage (music as automated residency), and Netflix House/Sandbox VR (streaming IP as mall‑scale LBE) are leading indicators, not anomalies.

Two Strange Loops: (1) Old IP ↔ New Tech (Oz resurrected in 16K domes; ABBA in avatar form). (2) Labour ↔ Automation (once captured, the “performance” can run all day without the artist). Audiences are complicit in the format mutation because the place‑based, premium spectacle feels worth it.

Forecast: expect a decade of venue–IP hybrids: a network of domes, avatar residencies, VR arcades and IP houses that turn catalogue assets into perennial attractions. Studios and labels supply IP; venue operators supply CapEx + tech; cities supply footfall; everyone shares margin.

🔒 Full Subscribers Only 🔒: A 2025-2035 operator’s playbook you won’t find in the trades: quantified KPIs, breakeven maths, deal templates, refresh cadences, early-warning signals, governance guardrails, and falsifiers. It’s designed so you can run, fund, or kill a venue–IP hybrid with discipline, not hype.

Cinema as pilgrimage product: The Sphere

The Sphere’s exterior—a 366‑foot dome wrapped in ~580,000 ft² of LED, seating ~18,600—designed to encircle audiences with imagery and effects (wind, scent, haptics). It is literally a cinema you travel for, not a cinema on your street.

CapEx: $2.3 billion build; 160,000 ft² interior screen (16K), ~580,000 ft² exterior LEDs, ~18,600 capacity; 4D effects (wind, scent, haptics).

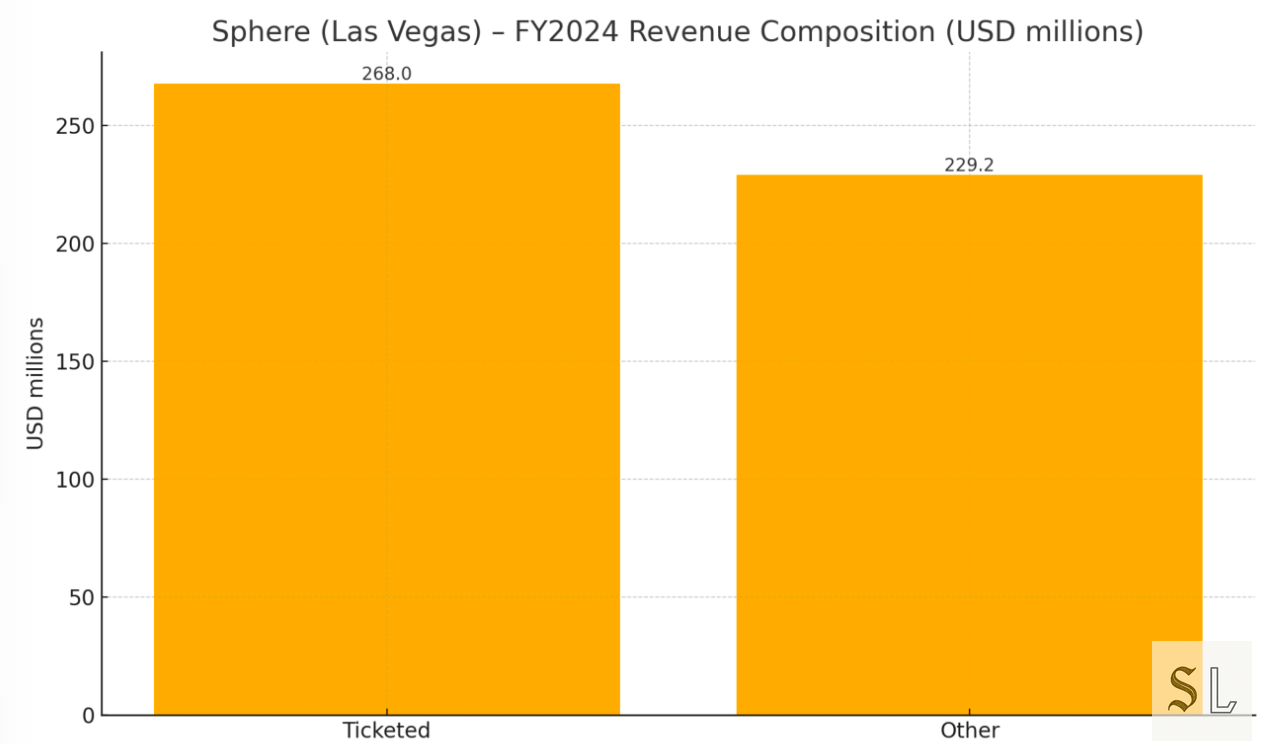

Revenue (as of FY2024 partial): ~$497 million; ~$268 million from ticketed events (U2/residencies, Postcard from Earth, NHL draft/F1), with the Exosphere (outdoor LED) delivering significant ad revenue; a reported early‑2024 ticket cadence of ~$1 million/day.

Format arbitrage: Sphere‑exclusive features price ~$100+ per seat and can replay multiple times daily; Wizard of Oz remaster cited at ~$80 million to produce. Once content costs are covered, marginal show cost is tiny.

This is IMAX economics × theme‑park margin with studio‑grade IP. By owning the only screen where the product exists, film becomes scarce, place‑based spectacle; in other words: pilgrimage.

Music as automated residency: ABBA Voyage

CapEx & capture: ~£140 million to build the 3,000‑seat arena and create ABBAtars via ILM; five weeks of motion capture; relocatable venue design.

Throughput: ~1 million tickets in year 1; ~3 million cumulative (as of mid‑2024); ~98% capacity in 2023; ~31% international audience.

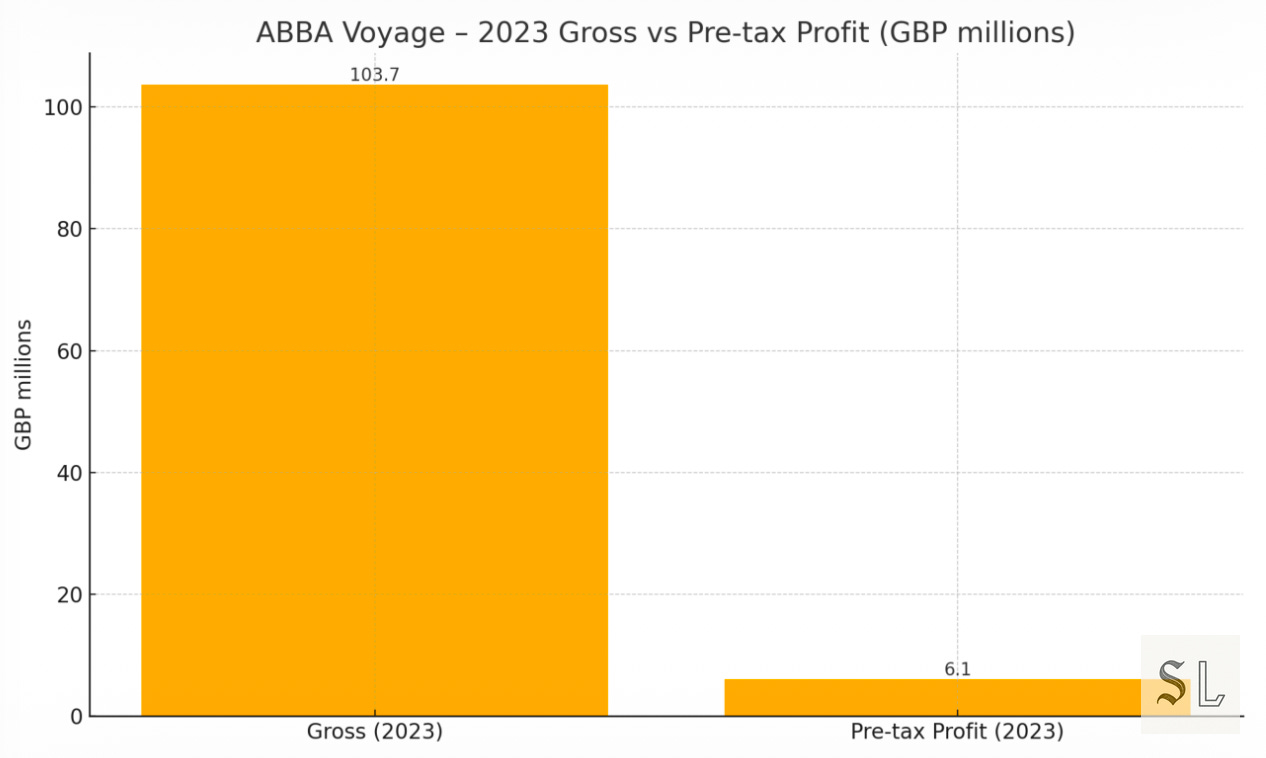

Unit economics (2023): ~£104 million gross across 374 shows (~£278k/show); pre‑tax profit ~£6 million as CapEx amortises; tickets ~£40–£100+ with a popular ~£55 standing option. Tourism uplift: ~£1.4 billion turnover; ~£775 million GVA; 5,000+ jobs supported (indirect).

Proof‑of‑category: a catalogue act turned into perennial, site‑specific cashflow with limited marginal labour, plus a blueprint for estates (e.g., Elvis) to license avatar residencies.

Streaming IP as mall‑scale LBE: Netflix House × Sandbox VR

Netflix House (2025): Two ~100,000 ft² mall retrofits (Philadelphia, Dallas) late‑2025; Las Vegas Strip flagship in 2027. Free entry → monetise micro‑experiences, F&B (Netflix Bites) and merch; content regularly refreshed (Stranger Things, Squid Game, Wednesday, Bridgerton).

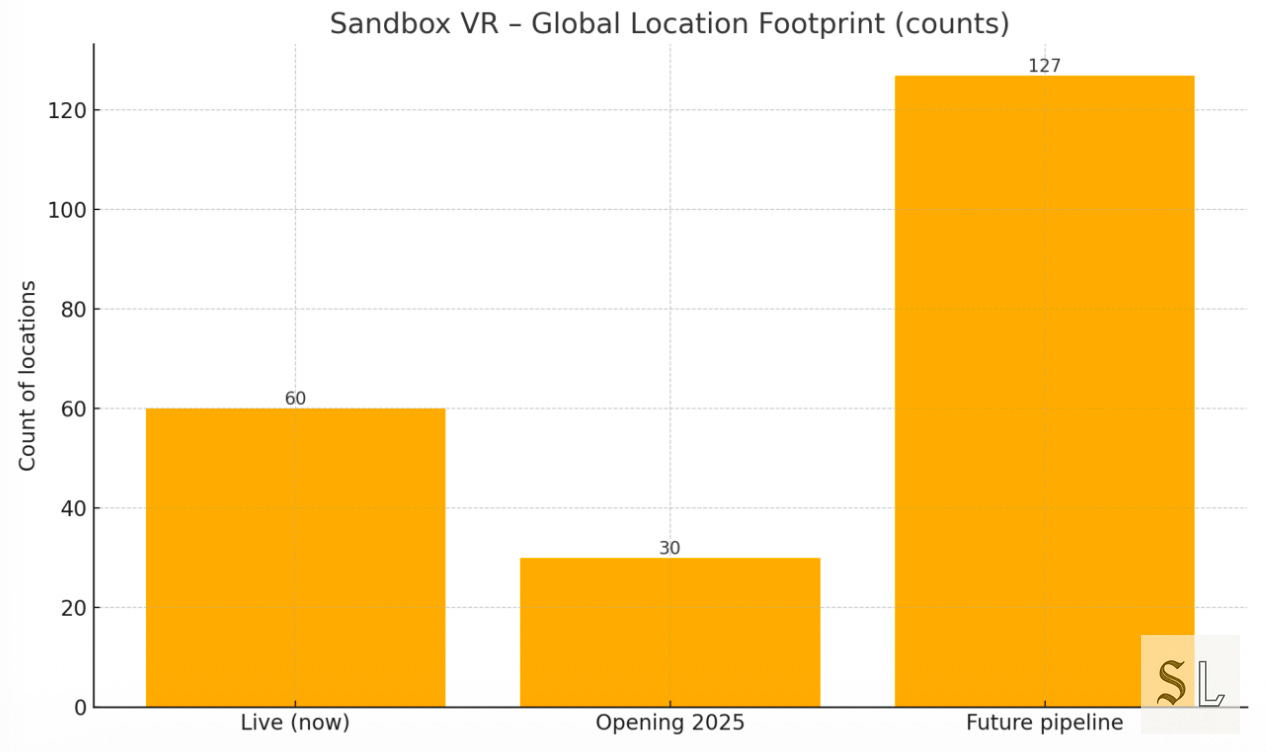

Sandbox VR: >60 locations live; 30 more in 2025; 127 in development (as of 2024); ~$50–60 pp for ~30 min; flagship zombie title >$100 million tickets; >$200 million lifetime revenue. Franchise model + mixed‑reality share clips drive scale. Deep Netflix IP tie‑ins (Squid Game Virtuals, Rebel Moon, Stranger Things).

Netflix is building the populist cousin of Sphere/ABBA: a distributed, lower‑CapEx network where fandom becomes habit. Sandbox provides the interactive core (and, if desired, an acquisition‑ready footprint). The economic logic is identical: own the venue, rent the IP, automate the show.

Predictions

Netflix (vs Disney, Comcast)

Netflix acquires Sandbox VR to take completely different approach than Disney and Comcast. Acquisition to stand up LBE at scale via a distributed, low-CapEx network that plugs straight into Netflix House (free-entry funnel → paid micro-experiences, F&B, merch). Acquisition compresses time-to-footprint, locks exclusive interactive rights on key franchises, and gives Netflix a repeat-visit engine that supports retention without taking on theme-park-level capital risk.

Sony

Likely path: Capital-light licensing and co-production, not venue ownership. Sony’s advantage is deep multi-format IP (Columbia/Sony Pictures, Crunchyroll/Aniplex, PlayStation Studios). Expect:

Licensed LBE across third-party operators (VR/AR rooms, anime pop-ups, e-sports lounges).

Selective equity in operators or sites (market-by-market) rather than a global roll-up.

Cross-stack activations (film/series + game tie-ins) with PlayStation-grade interactivity inside partner venues.

Rationale: Preserves focus on content and platforms; avoids venue OPEX; maximises royalty annuities from a broad operator base.

Paramount

Most probable: Licensing and branded zones, not big-ticket builds. Use Nickelodeon/Paramount brands in malls and family-entertainment centres; eventised pop-ups around Star Trek, Mission: Impossible, Top Gun-adjacent aviation sims, etc. Why:

Balance-sheet caution and strategic flux make a capital-light, partner-led approach the rational near-term move.

Paramount can still win by packaging IP bundles for operators (seasonal refreshes, character appearances, kids’ programming blocks) and by tying LBE to Paramount+ beats (churn defence via fan engagement).

The operating system: Own the box, lease the myth

Core mechanics

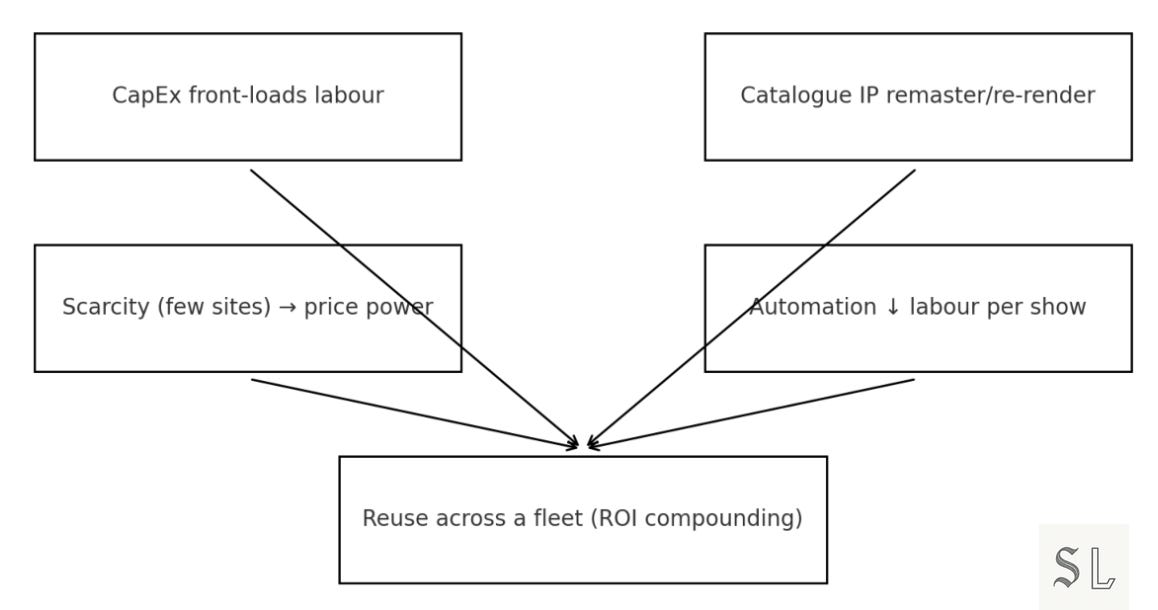

CapEx front‑loads labour into tech and build; marginal shows cost little.

Catalogue IP (film/music/TV) is remastered or re‑rendered to the venue’s format.

Scarcity (one‑or‑few sites) keeps price power high.

Automation depresses ongoing labour per head.

Network effects arrive when content circulates across a fleet of venues (Sphere‑Abu Dhabi; relocatable ABBA Arena; Netflix Houses × Sandbox).

Two Strange Loops at work

Old IP ↔ New Tech: The Wizard of Oz in 16K with AI‑assisted restoration and bespoke physical effects; ABBA performing nightly without “being there”; Netflix worlds operationalised as games, sets, and menus. Nostalgia × novelty = pricing power.

Labour ↔ Automation: once captured, a performance scales like software. The humans per $1 m revenue ratio shifts from performers to technicians/maintainers/designers. Fans accept this because place + awe feels like value, even if the “artist” is virtual.

Why stakeholders allow it

Studios/labels/estates: Low CapEx, high option value. License dormant assets into new annuities (e.g., WBD with Oz; estates for Elvis/Bowie), often with venue‑funded production and royalties.

Artists: Better bottom line, less wear and tear. Residency avoids touring burn; avatar shows future‑proof legacy. Dolan’s point is blunt: content becomes “less expensive” when you stop dragging it across 50 cities.

Cities: Tourism multipliers. Voyage’s London footprint shows £1.4 bn turnover impact and 5,000+ jobs supported—policy‑relevant numbers.

Platforms: Retention and retail. Netflix House converts bingeable IP into repeatable, physical touchpoints that support subscription stickiness and new SKUs.

Risks (and how to price them)

Novelty decay: the “wow” fades. Mitigation = content cadence (seasonal refresh), portfolio rotation (classics + originals), and tiered pricing to widen TAM mid‑run.

Authenticity backlash: “art without artists” critique; solve via craft quality, transparent crediting, selective live elements (Voyage’s band), and ethical likeness governance.

CapEx overreach: don’t build cathedrals in non‑pilgrimage markets; consider 5,000‑seat variants for second‑tier cities.

Legal/union friction: lock AI/likeness clauses; engage guilds early; codify avatar rights norms.

Playbook: how to build a venue–IP hybrid

For studios/labels/estates

Prioritise catalogue with universal semiotics (Wizard of Oz‑level iconography; era‑defining acts). Assess remasterability: does the asset upscale to hyper‑resolution or translate to avatar fidelity?

Deal stack: licence on venue‑funded CapEx, plus royalty override; reserve creative control clauses (AI/likeness guardrails) to protect brand and guild relations.

For venue operators

Unit design: either cathedral scale (Sphere) for destination pricing, or modular mall hubs (Netflix House/Sandbox) for frequency. Build content reuse into the network (Abu Dhabi/relocatable arenas).

Ops KPI: humans per $1 m revenue, days‑to‑refresh for new content, and per‑cap spend across tickets/F&B/merch.

For cities/authorities

Tourism calculus: Voyage‑style numbers argue for accelerated permitting, site assembly, and potentially incentives, given outsized local spend.

🔒 Full Subscribers‑only Coda: The Operator’s Playbook (2025–2035)

Why this matters: If “own the box, lease the myth” is the new OS, advantage accrues to teams that treat venue‑IP hybrids as an engineered system, not a stunt. Below is a field checklist you can use to evaluate, build, or invest in these plays without hand‑waving.