The Platform Formerly Known as Coachella

The business of youth culture’s seasonal IPO — and how a desert music festival became a vertically integrated platform for monetising desire, visibility and brand adjacency in the attention economy.

It starts, as these things often do, with a TikTok.

Two lemonades. A tray of tacos. $102.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

The angle is off and the lighting’s flat, but the moment lands. It’s shared, memed, moralised — not because it’s absurd (though it is), but because it’s recognisable, familiar. It’s the kind of video that doesn’t go viral because it surprises us, but because it confirms what we already know:

That participation now comes with a surcharge, presence has a price and we are living inside a culture defined less by what we experience than by how we render it.

Because Coachella isn’t really a music festival anymore — certainly not in the way we used to mean it. Not in the “lineup and a tent” sense.

It’s something else now — something infrastructural; a high-margin, low-churn, vertically integrated experience stack.

…like a fintech media company disguised as a cultural pilgrimage.

…like a recurring revenue platform with flower crowns and drone shows.

It’s… HBO meets Shopify meets Klarna meets IRL FOMO.

It’s… behavioural finance wrapped in sequins.

So, no, this isn’t about overpriced nachos. It’s about the systems underneath the spectacle — the ones that turn anticipation into revenue, intimacy into content, memory into yield.

It’s about how culture is now built to be subscribed to, amortised, packaged into loops.

It’s about how a $649 GA wristband isn’t a ticket — it’s a license to perform presence, finance desire and broadcast your own relevancy in real-time.

Because we’re not just attending anymore, more so we’re broadcasting. We’re both the audience and the performer.

And Coachella — quietly, elegantly — has become the clearinghouse for that performance.

So, this also isn’t just about Coachella. It’s about us.

About where culture goes when it runs on platform logic.

The loop we’re all caught inside.

The simulation we keep rehearsing.

And the future — not arriving, exactly, but uploading itself, one tagged moment at a time.

Today We’re Talking About:

How Coachella stopped being a festival and became a multi-revenue cultural syndicate with SaaS-level economics and better merch

Why a $649 wristband unlocks a $2,750 spend journey — and why 53% of that is financed, not felt

The $27 million advance float hidden inside a payment plan marketed like a vibe

What $60M in brand activations reveals about the new geography of attention — from Aperol tents to Klarna logic

Why YouTube treats Coachella like House of the Dragon — and what happens when a festival becomes a franchise

Why headliners like Cardi B and Blackpink don’t play for money — they play for narrative equity

How Gen Z turned “going to a show” into a five-stage identity pipeline, complete with story arcs, aesthetic labour, and post-event content syndication

Why 90+ festivals cancelled in 2024 — and why Coachella didn’t blink

What happens when a music festival masters scarcity, virality and infrastructure economics simultaneously

Why Coachella is youth culture’s seasonal IPO — and what that teaches us about the monetisation of memory, visibility, and social proof

And maybe, why this essay isn’t about Coachella at all. It’s about what happens when the vibe becomes the platform.

Today’s post is exclusive to paid subscribers — a deep dive into how Coachella became the most advanced cultural platform disguised as a party. If you’re not yet subscribed and this kind of analysis hits, consider joining to access the full essay and future dispatches from inside the loop.

The Experience Machine

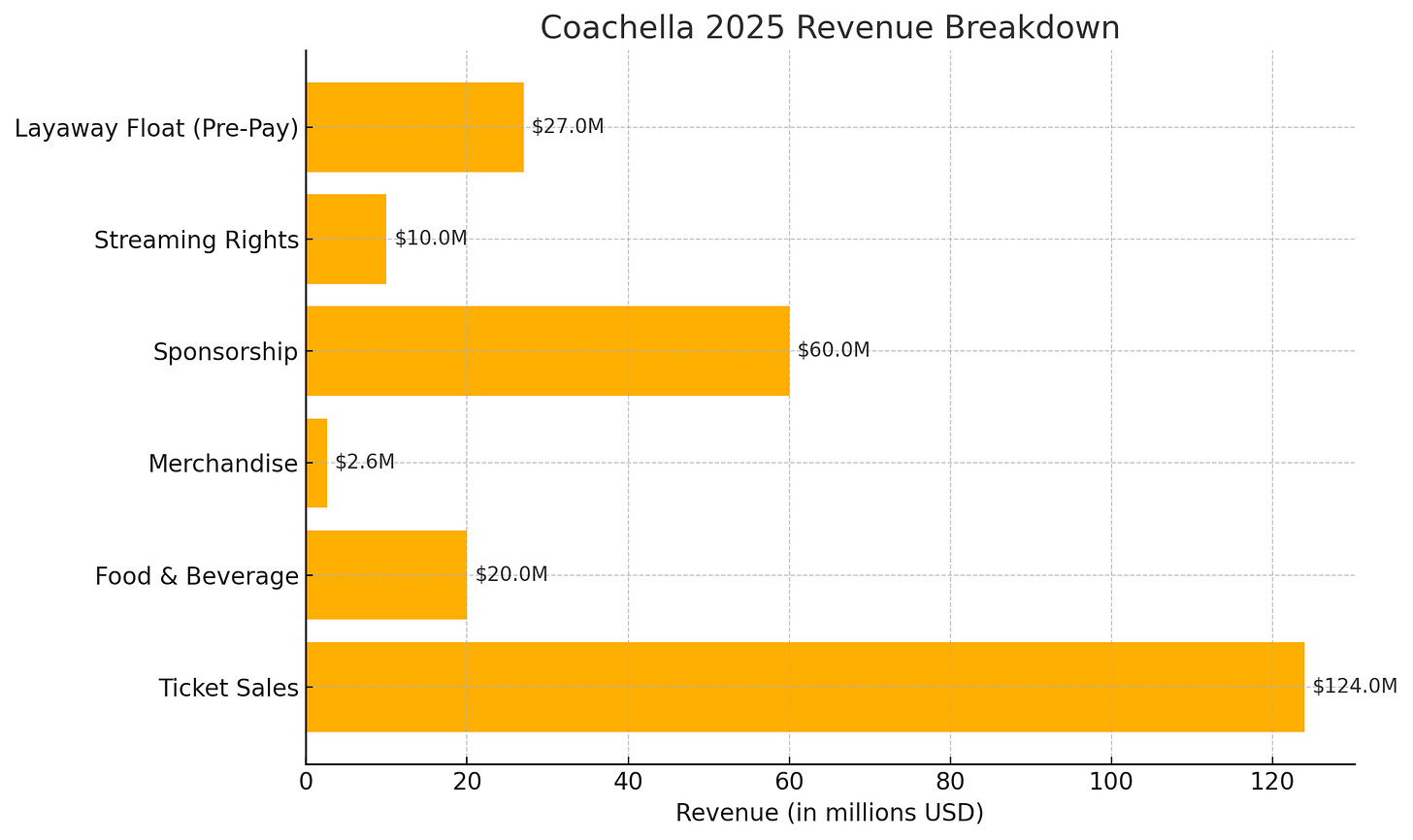

Coachella 2025 grossed an estimated $214 million, with EBIT margins in the 27–30% range. Let that land for a second. These aren’t numbers from a crypto-backed tech startup or a Hollywood franchise. These are margins from a music festival — an outdoor, sunburn-risking, $17-lemonade event in the middle of the desert. Most festivals are lucky to scrape by in single digits. Coachella is running live events like it’s managing a hedge fund.

So, how does the machine work?

Let’s break it down:

Tickets: 170,400 sold across two weekends. General admission accounts for 72% of total sales. Just GA alone brings in over $90 million. VIP passes? Another $30M+. Safari tents, boutique yurts, glamping micro-fortresses with A/C? That’s your upper funnel — the Coachella equivalent of “enterprise SaaS.”

Food & Beverage: The average attendee spends $117 over three days, mostly to survive the sun and document it online. Multiply that across the crowd and you’re looking at $20 million in tacos, hydration and lightly aspirational wellness cocktails. Every $17 lemonade is part of the monetisation stack.

Merchandise: Roughly $15 per head on average — which sounds modest until you realise it’s a pure margin category. That’s $2.6M in branded scarcity: shirts people wear once, hoodies that never wash out the Indio dust, and posters to prove you were “there” even if you mostly sat in the beer garden.

Sponsorships: Over $60 million in brand deals. Heineken, Klarna, Amazon Creator Cloud, Pinterest, Hyundai, Aperol — all anchoring activations, lounges, creator houses, branded drink zones and digitally native experiences. Klarna alone underwrites part of the payment plan float. This isn’t sponsorship — it’s infrastructure (more on that shortly).

Streaming & Media: YouTube’s multi-year rights deal is conservatively worth $10–12 million, with Coachella pulling in 55% of livestream ad revenue across 82 million live-starts. That’s another $5 million in cash — before you even count the click-to-buy merch funnel or YouTube Music MAU halo effect. Think of it less as “livestreaming” and more as Coachella’s broadcast layer — HBO with glitter.

Now, here’s where it gets quietly brilliant: Coachella doesn’t just make money from what people buy on-site. It makes money before they even know they’re going.

60% of general admission attendees use Coachella’s layaway system: $99 down, four further payments and a ~$27 million advance float across the cycle.

That’s not a ticketing policy — that’s a seasonal consumer finance business, wrapped in vibes and timed to hit your card just before student loan repayments resume.

Coachella isn’t just monetising attendance. It’s monetising anticipation. It’s pre-loading revenue, smoothing cash flow, and reducing default risk by gamifying desire. It’s Klarna culture in the wild — a platform where FOMO is financeable and the checkout cart is a dopamine loop.

This isn’t a music festival — it’s an annualised experience stack optimised for cultural relevance, recurring revenue and behavioural lock-in. If you want to understand the future of entertainment economics, you don’t look at movie studios. You look at the $102 nachos and what they’re floating.

Coachella is SaaS with Sunsets

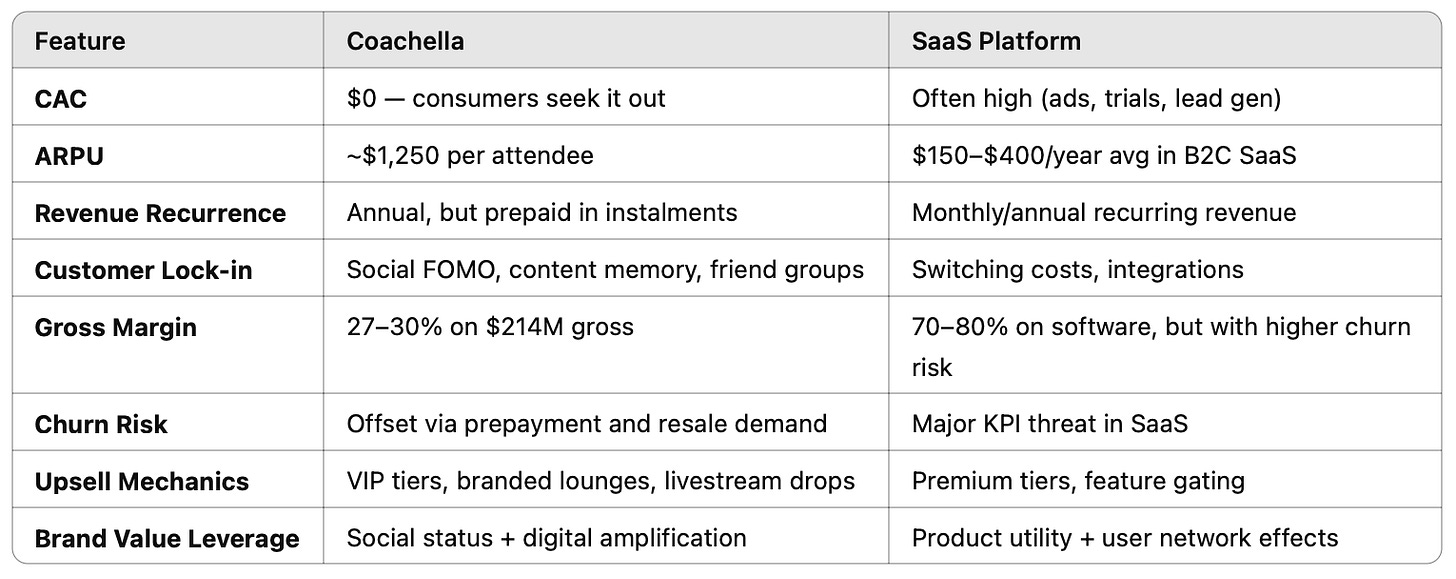

So let’s go back to that big statement: Coachella isn’t a festival — it’s an annualised experience platform. How? It has: retention loops, monetisable tiers, behavioural incentives and amortised access. In strategic terms, it looks less like an event company and more like a consumer-facing SaaS business in seasonal form.

Just consider the structure:

Recurring revenue through annual pre-sales, timed drop calendars and layaway-driven behavioural lock-in.

Tiered pricing from GA to VIP to boutique yurts and A/C glamping—like freemium-to-premium feature ladders.

Frictionless upsell: shuttle packages, merch drops, exclusive on-site F&B experiences all built into the purchase path.

Social switching costs: once you’re in, you’re in. Opting out means missing out—on group chats, on content cycles, on cultural presence.

And here’s the kicker: the entire model is prepaid. Attendees finance their desire via $27M in advance float, while Goldenvoice minimises risk and maximises early cash flow. The net result? Coachella has stronger predictable top-line revenue and lower event risk exposure than most SaaS startups managing churn.

The comparative unit economics are startling. Coachella’s average revenue per user (ARPU) is $1,250+ per attendee, far outpacing the B2C SaaS median. And while SaaS platforms fight to retain users with dashboards and Slack integrations, Coachella does it with sunsets, social proof and scarcity theatre.

This is why the $102 nachos matter. Not because of inflation. But because they’re part of a platform logic that understands how to monetise memory, identity and annualised desire — the way Netflix monetises attention or Shopify monetises transaction volume.

Coachella is SaaS, but the subscription is cultural relevance.

Content as Infrastructure

The Coachella livestream isn’t marketing, it’s plain ol’ media. It’s a tentpole cultural asset engineered to operate less like a recap and more like a revenue-generating broadcast layer — scaled, sponsor-wrapped and monetised with all the precision of a network series launch.

This isn’t “we’re streaming the festival,” more: “we’re programming an annual digital event with an 82-million-viewer reach and multi-modal monetisation strategy.”

Here’s how that breaks down:

Blackpink’s 2023 headlining set: 2.96 million peak concurrent viewers. That’s not just more than most live TV events — that’s more than the NBA Finals and Oscars in some territories.

2024 livestreams: 82 million live-starts across both weekends. Average YouTube eCPM hovers around $0.38, putting gross ad value at ~$17 million. Goldenvoice retains 55% post-creator split, netting about $5M in ad share.

Commerce layer: Coachella’s integration of click-to-buy merch during livestreams (Shopify’s new “Shop the Stream” pilot) yielded 64,000+ units in 2024. With a projected 12–15% lift in 2025, this is an emerging channel with more upside than GA ticketing.

Platform halo: YouTube’s internal valuation of the Coachella deal isn’t just about ad revenue — Alphabet analysts reportedly peg the incremental lift to YouTube Music MAUs at $48M in platform value.

And the best part? It’s all free. Not freemium, not metered, not tiered. Free to the viewer — subsidised by Alphabet, sponsored by brands, monetised by creators and commerce. A digital Trojan horse with three exits: ad revenue, social virality and merch conversion.

That makes the Coachella livestream less a coverage layer, and more a syndication engine — built to be globally scalable, endlessly shareable and algorithmically evergreen. Every stream generates its own downstream content economy: Shorts, reaction videos, TikTok clips, YouTube remixes, doc trailers and more. It doesn’t compete with live attendance. It expands it.

Think of it this way:

For YouTube, Coachella is a franchise event — a way to flex its cultural relevance to Gen Z, drive up Music MAUs and showcase creator-integrated commerce tools to advertisers.

For Coachella, YouTube is a global media partner with zero capex and full-stack distribution: stream the show, sell the shirt, clip the moment, convert the culture.

In platform terms, this is syndication without scarcity. The stage is streamed. The sets are clipped. The archive lives on. And the content itself? It’s infinite inventory — repackaged and monetised on loop.

You don’t “watch” Coachella anymore. You subscribe to it.

Increasingly, what Coachella produces isn’t just music or moments — it’s training data.

The performances become inputs. The audience becomes a dataset. The feed becomes a proxy for relevance.

In a near-future where Sora, Runway, or OpenAI can render a Beyoncé concert in seconds, Coachella’s differentiator isn’t content — it’s live social context. The IRL-ness becomes the final moat.

Or maybe it becomes the next dataset to be trained on.

Artists Don’t Play Coachella for the Cheque

On paper, Coachella’s headliner fees are impressive.

In 2025, the top tier — think Bad Bunny, Blackpink, The Weeknd — earn $5–8 million for two weekends of mainstage presence.

But if you think this is about the money, you’re reading it backwards.

Coachella is not a cash play. It’s a platform move.

Because while the cheque is solid, the real ROI lives downstream — in streaming surges, global visibility, documentary rights, brand campaigns and cultural positioning. In 2025, the mainstage is the new media launchpad.

Consider a few now-iconic cases:

Beyoncé (2018): Paid approximately $8M for her historic set. But she negotiated full control of the footage, parlaying it into Homecoming — a Netflix doc reportedly worth $20M+, plus merch drops, cultural prestige, and an Emmy. That wasn’t a concert. It was a multi-channel IP asset.

Cardi B (2018): Earned $140K per weekend. Spent over $300K of her own money on dancers, sets, and production. On paper, a loss. But in brand terms? An inflection point. It confirmed her as a superstar — not just chart-topping, but stage-commanding, fashion-aligned, brandable. The Coachella effect.

Blackpink (2019): Their U.S. debut was a sub-headliner set. But the clip economy went nuclear — TikTok, Twitter, YouTube replays, K-pop stan accounts. Post-Coachella, they became luxury brand ambassadors and sold out U.S. arenas. This wasn’t just visibility. It was platform transformation.