The Biggest Story No One Talked About at MIPCOM

👋🏼 A sincere welcome to all the new readers from MIPCOM. It was great to meet you all and welcome to the party. For those of you in London, announcing the invite-only annual predictions lunch is now set for 20 November at Hotel Cafe Royal. If you’re not already on the interest list, feel free to reach out.

Windowing is platform-native now

The trades wrote up YouTube’s MIPCOM splash like a creator crèche: cute, influencer selfies, moving on. Wrong lens. YouTube wasn’t doing vibes in Cannes but selling the primary release surface.

As my trusted readers already know, YouTube has been the No. 1 U.S. TV media distributor for six consecutive months through July 2025 (13.4% share). In the UK one in five kids starts their TV session on YouTube. For under-40s, late-night, highlights, podcasts, and creator series launch on YouTube-on-TV. Everything else trails the meme dust.

Days before Cannes, Meta said Instagram is exploring a TV app. That’s not a footnote either. This is the beginning of the second front in the living-room war. Moving Reels from thumb to sofa isn’t a port, but a physics change: lean-back sessions, co-viewing, third-party measurement, algorithms tuned for longer arcs.

And legacy coverage? Still grading with the old rubric: 42-minute packets to SVOD/linear, geo-locked crumbs, YouTube filed under “marketing.” That framing misses why YouTube was in Cannes at all: to sell first-window distribution.

So let’s get to it and break it down. (And because it’s important to debate, I’ve got you covered after the paywall.)

What actually happened (and when)

9 Oct 2025 (PRE-MIPCOM!): At Bloomberg Screentime in LA, Adam Mosseri said Instagram is “exploring” a dedicated TV app, calling it a mistake not to have moved sooner and signalling no premium sports/Hollywood licensing in scope. MIPCOM ran 13–16 Oct, so this landed just before the Cannes market. Coverage was led by Bloomberg and tech/business outlets, with limited pick-up in the core Hollywood trades.

Why this matters

YouTube already owns the living room. In Nielsen’s Media Distributor Gauge, YouTube led U.S. TV viewing share for months in 2025 (e.g., 13.4% in July), widening its lead over Disney and others. Any IG TV app is competing with the incumbent on its strongest surface. And it’s a big f(*&king deal we’ve added algorithms to the TV.

Windowing has shifted

YouTube is the de-facto “first window”. Ofcom’s 2025 report shows YouTube is the first destination on TV sets for UK kids and the most-watched service among 16–34s. It’s now second only to the BBC overall in the UK. For late-night, sports highlights, podcasts and creator series, the first release window is YouTube on TV, not broadcast or SVOD. Shorts already made the jump to TV. YouTube solved the “vertical-on-TV” UX in 2022. That’s the bar IG must clear to avoid a blown-up phone feed.

Commerce & CTV budgets are aligned with YouTube today

YouTube is now shipping CTV-native shopping formats (product feeds/QR), which is where incremental brand spend is testing.

(Yes, yes, we’re including YouTube within streaming. Because it doesn’t matter if it had a lot back in the ‘50s, it’s entertainment.)

The product/market gaps Instagram must close to truly compete

Format & policy: IG’s own Help Centre states reels over 3 minutes aren’t recommended to new audiences. That throttle fights TV’s lean-back sessions until IG changes recommendation rules (even after the cap rose to 3 minutes in 2025).

Supply: IG lacks a large corpus of mid-form (5–30 min), 16:9, TV-intentional content. Without funding and/or CTV rev-share, creators won’t build it. (Meta has reconfigured creator payouts, but there’s no explicit CTV rev-share yet.)

UX: To pass the sofa test: continuous queues, segment slates, remote-first controls, AI reframing for 16:9, audio normalisation, profiles for co-viewing (i.e., the design work YouTube already shipped for Shorts on TV). Short vertical already works on TV (YouTube solved the UX in 2022. The bar for IG is TV-native, not ‘blown-up phone.)

Measurement: CTV buyers want third-party, co-viewing-aware reach. YouTube has a mature (if debated) approach. IG will need Nielsen-grade reporting to unlock brand budgets.

Why Sceptics Are Likely to Be Wrong (Again)

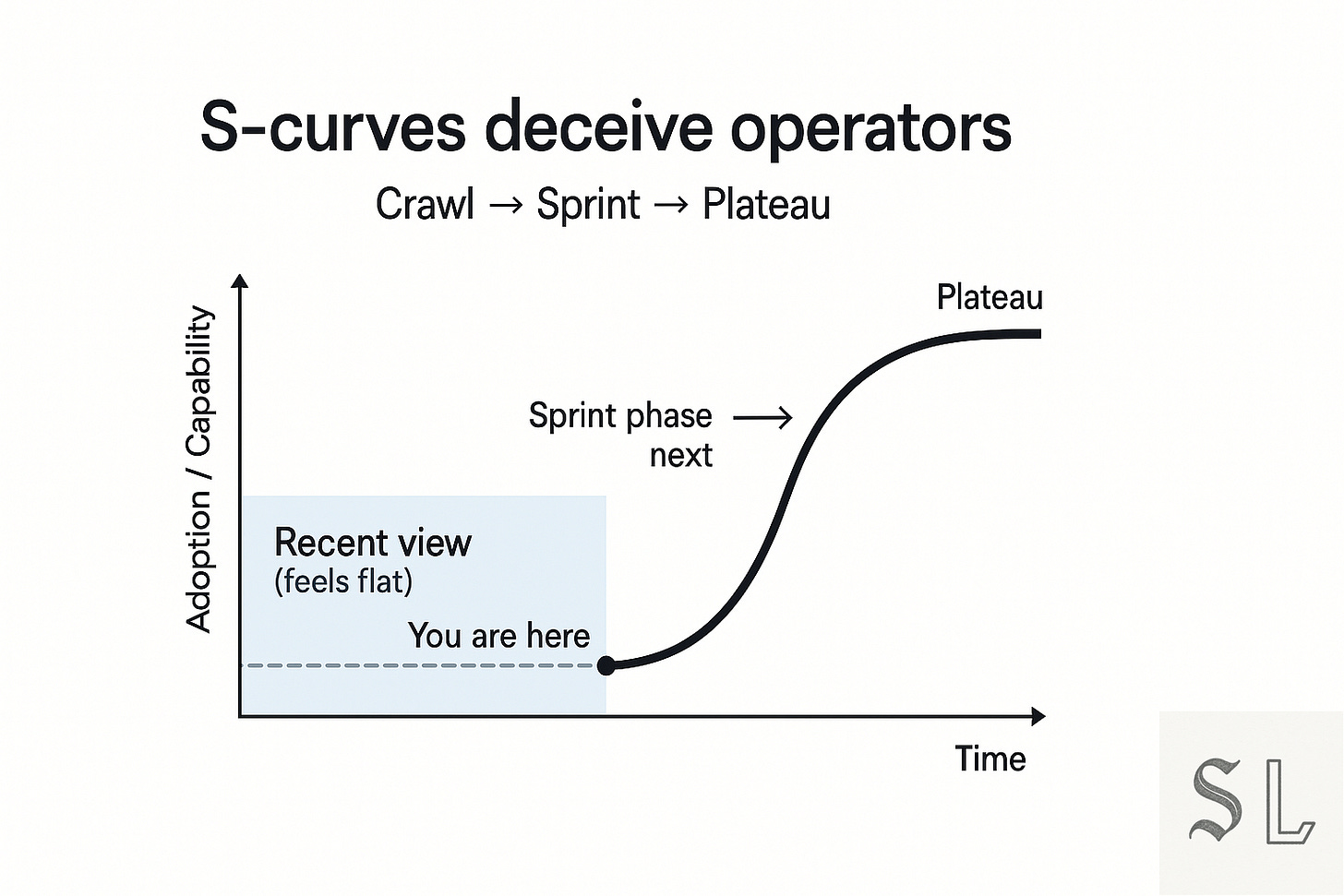

Those of you in attendance at MIPCOM will remember this visual:

The crawl looks flat, so people anchor on the last 90 days and say, “No one wants vertical video on TV.”

Early IG-on-TV will feel novelty-ish before the levers move: recommendations (>3-min throttle), funding (mid-form supply), TV-native UX (remote, reframing, queues).

When those flip, session length sprints (classic S-curve).

It’s the YouTube pattern: dismissed as “phone content,” then UI, measurement, and creator economics clicked and it became the first window.

DO NOT price the sprint at crawl rates and instead build for it.

Let’s Debate It

Counter: “YouTube isn’t a first window for us.”

For late-night, highlights, podcasts, creator/talent talk and newsy recap formats, the first release with real cultural lift is already YouTube on TV. Premium sport and first-run scripted stay rights-native. Different game, same living room.