Fresh off opening Content Canada Wednesday and T-minus a week and some change from the opening keynote at CineLatAm, I’ve landed in LA to do some private briefings for the majors. LA is still my favourite hometown fever dream: the valet has a WGA credit, the Erewhon smoothie is repped at CAA, and the 405 just got optioned by A24 for a limited series about traffic trauma. 🙏🏼 Bless.

And right on cue, the New York Times drops Hollywood’s annual summer obituary, written like a studio note that just says: “Could the corpse be sexier?” Adorable.

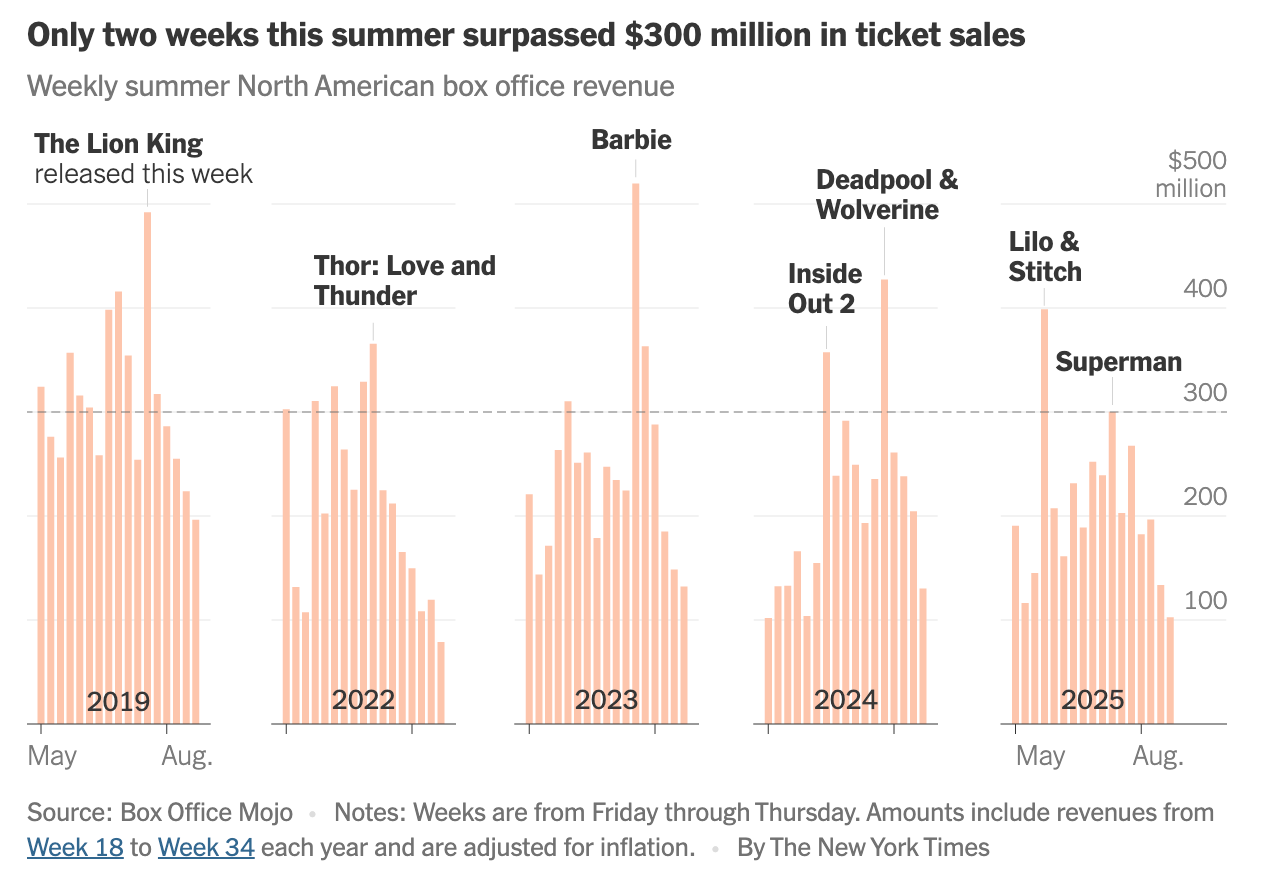

Summary: Two $300m weeks instead of nine. Franchise logos that read like warning labels. The usual suspects rounded up for the usual verdict: theatrical is dying.

Problem is, they’re diagnosing the symptom, not the disease.

At CineEurope, I argued that cinema’s real competition isn’t AI or Netflix at 2am but the couch at 7pm. Attention, not content, is the scarce commodity. Theatrical’s constraint (four walls, fixed time, shared ritual) is precisely its moat against algorithmic infinity.

When we the NYT asks “Is cinema dying?,” they pre-load the verdict. The right question is How do we ignite attention in an algorithmic economy built to fragment, frack, and auction it, no matter your format, your message, your artistry, or your budget.

It’s easy to call this a demand problem, but that’s cursory. The deeper issue was Summer’s portfolio shape.

Releasing twenty franchise films does suggest an unending belief that familiarity breeds desire. But sadly we know that in feeds it actually breeds indifference.

Returning IP doesn’t always compound and instead it often decays. And yet marketing still buys blunt reach in an attention economy that only rewards resonance.

So let’s use the NYT autopsy as a blueprint, not to defend theatrical as prestige, precious, or nostalgia, but to treat it as cultural infrastructure: one of the only reliable systems that converts attention into memory, memory into momentum, and momentum into money.

Because if you can’t create peak weeks, you’re not in the movie business. That’s called the content business. And that’s a whole other thing.

Today We’re Talking About

Why summer really collapsed: not “weak demand” but novelty + slate shape. I’ll show how the seasonal curve looks when ignition is missing.

The new greenlight test: Minimum Viable Novelty (MVN): one-second legibility, an emotional hook, and real remixability. No MVN, no scale.

The upstream engine: why theatrical ignites the flywheel (and streaming rides the wake). Think Barbie—attention → merchandise/licensing → durable value.

Designing peak weeks: Peak-Week Velocity (PWV) as the operator metric. If a title can’t credibly clear it, re-price or rescope. Then manufacture spikes with eventisation + PLF.

What the NYT Just Validated

The bottleneck is attention, not format.

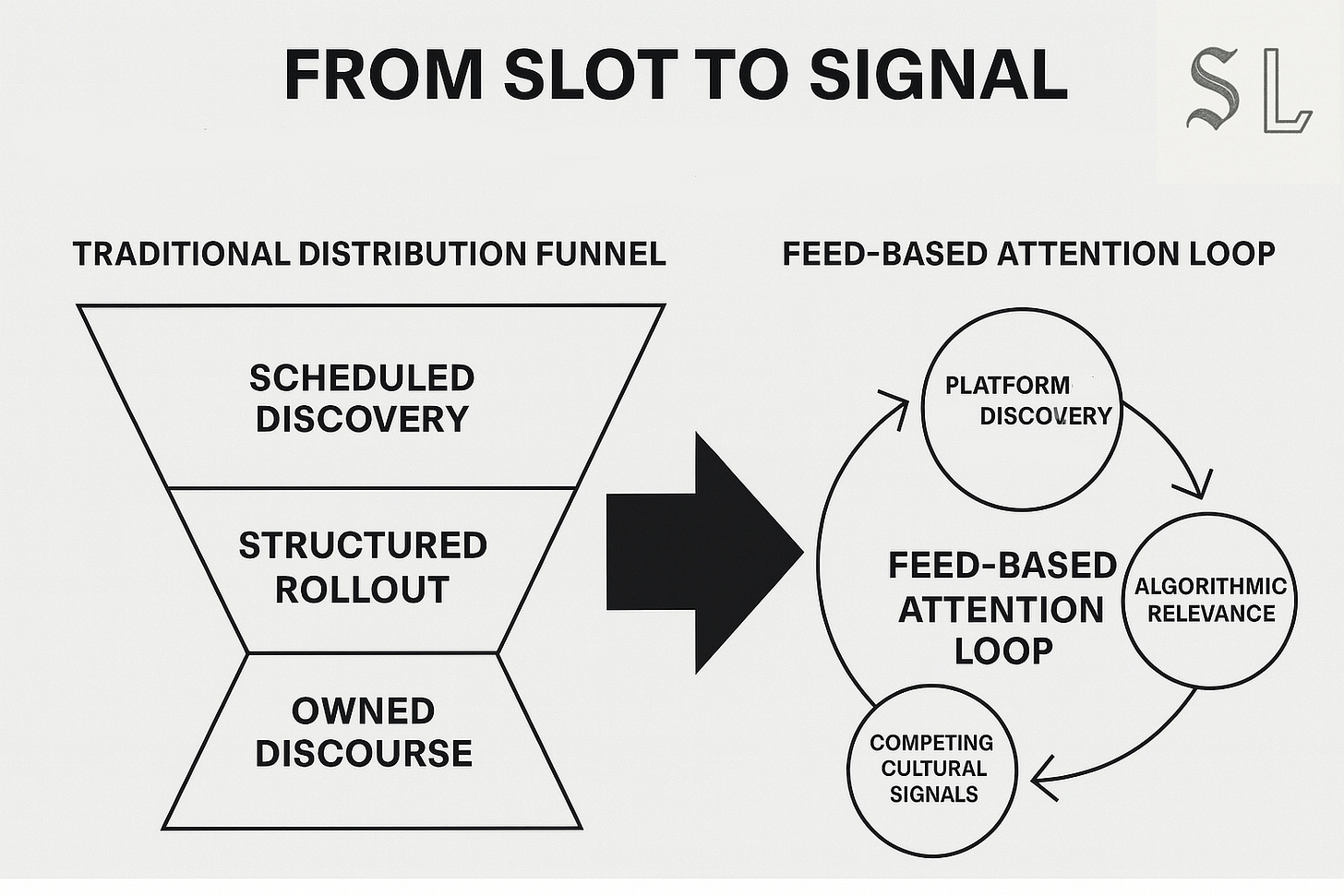

Where we agree: summer’s corpse is about culture losing the feed war. Where we disagree: this has nothing specifically or uniquely to do with cinema-going itself. The real enemy is an attention economy that turned discovery into chaos. The Times provides the body count: only two $300m weeks vs nine in 2019, a top-five haul of $1.6bn vs $2.6bn (inflation-adjusted). This is “launching into a feed” in practice: you’re not competing with other releases but with a TikTok of someone rating their ex’s apology texts that somehow has 4M views right now. Distribution moats: flattened. Mass marketing: screaming into the void. Physics: attention fragments upstream; peak weeks evaporate downstream.

Familiar IP without ignition underperforms.

The Collapse → Churn → Ignition model shows the feed rewards the already familiar unless it carries a sharp, remixable signal. Only Ignition cuts through: remixable, emotionally sticky, visually legible in one second. Collapse is indifference with a budget: the logo launches, the feed scrolls. The Times confirms it: 20 of 26 summer films over $20m were franchise entries, more than half underperformed their predecessors. Familiarity ≠ resonance. Logos are not lures; without ignition, franchise becomes taxonomy, not traction.

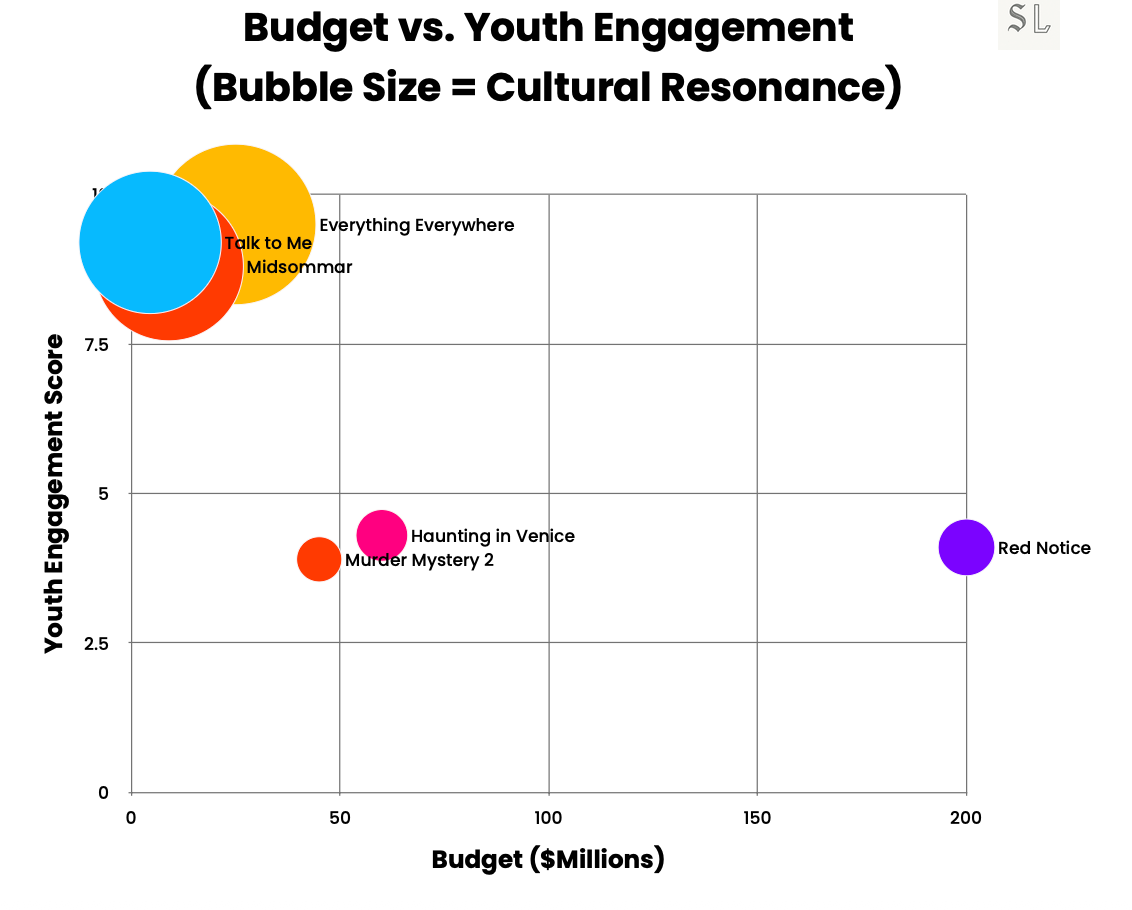

Winners are distinct, legible, and often auteur-anchored.

In an infinite feed, taste is scarcity; clarity beats tonnage. The data shows youth engagement clustering around low-budget, tonally distinct films and trusted curatorial filters (A24/MUBI), not star spend or logo scale. Sinners demonstrated it: auteur loyalty + Black-history communities + Southern-Gothic emotion created ignition before mass metrics moved. The Times shows the same: newer series or clean hooks—28 Years Later reuniting Danny Boyle—won on distinctiveness, not familiarity. Rule: design for one-second legibility with an authorial signal people want to carry.

Discovery is platform-native; schedules don’t convince Gen Z.

76% of Gen Z discover on TikTok/YouTube, most content peaks within 48 hours, and 60% of trailer viewers can’t recall the release date. In EU5, 65% of TikTok users engage in film discovery; 63% of Gen Z discover via social vs 28% from streamer recs; 50%+ trust Letterboxd/Discord/TikTok over Rotten Tomatoes. In that world, a release date is not a strategy; it’s a footnote to a signal. The Times calls it: harder to concentrate attention, weaker weekly peaks. If discovery begins in the feed, the calendar only works when the signal does.

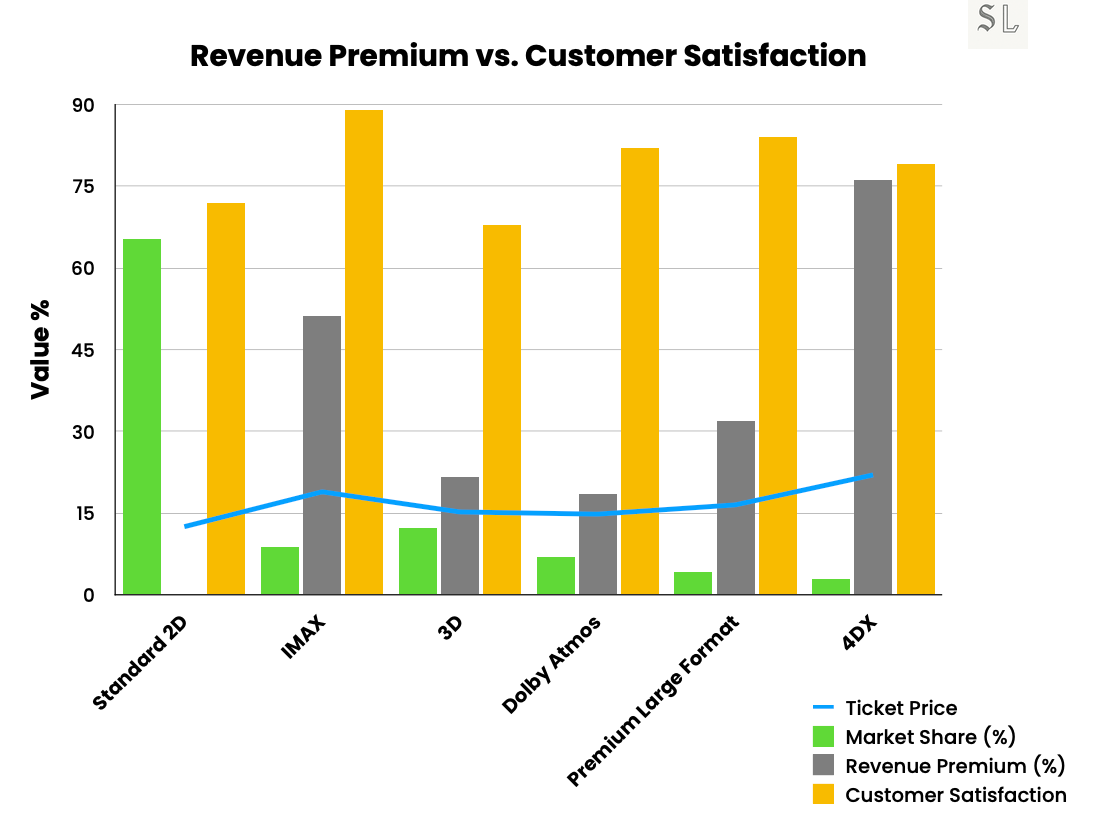

Experience and premium formats are economic multipliers, not luxuries.

IMAX/PLF = <15% of shows but >45% of revenue, command 40%+ ticket premiums, deliver +18–25pt satisfaction lift. Win the nights that decide the P&L (Friday, or Saturday in Chile) and you change the week’s economics. The playbook is practical: convert ~2% of weekly showtimes to premium, lock four eventised nights a quarter (+27% per-cap spend), and make fewer moments unavoidable. The Times shows the penalty for skipping spikes: a summer with two $300m weeks where 2019 had nine. Premium isn’t décor; it’s the yield engine when the slate is thin.

Theatrical as launch protocol for broader IP economics.

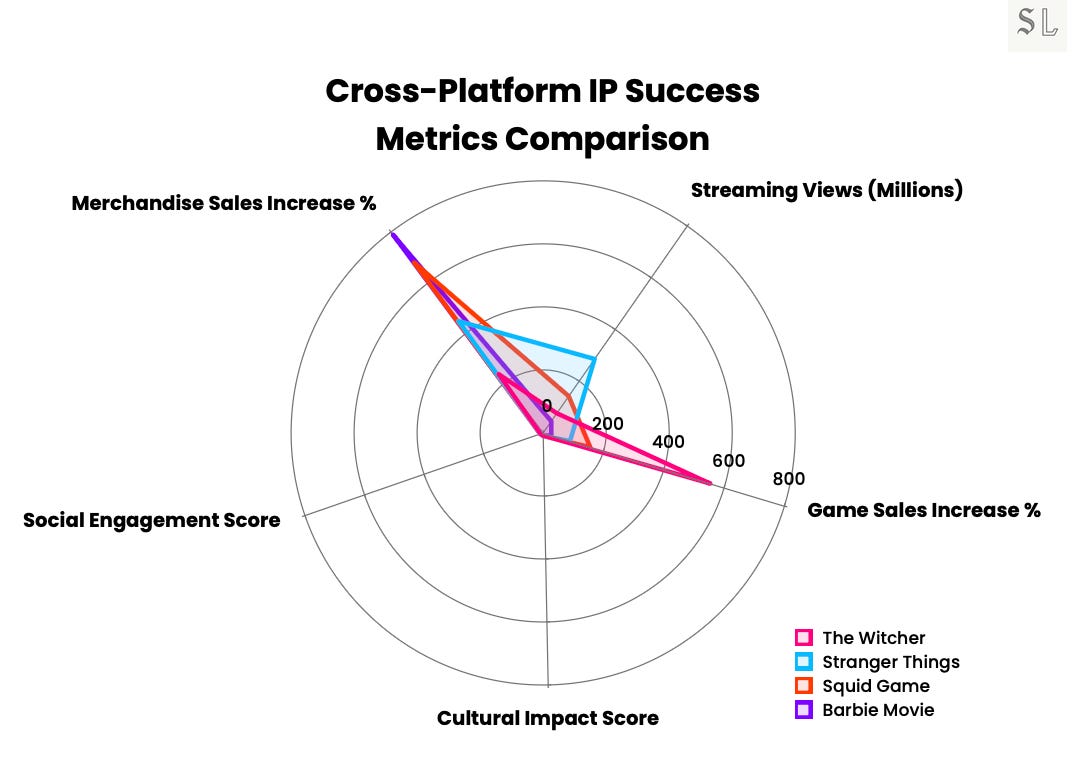

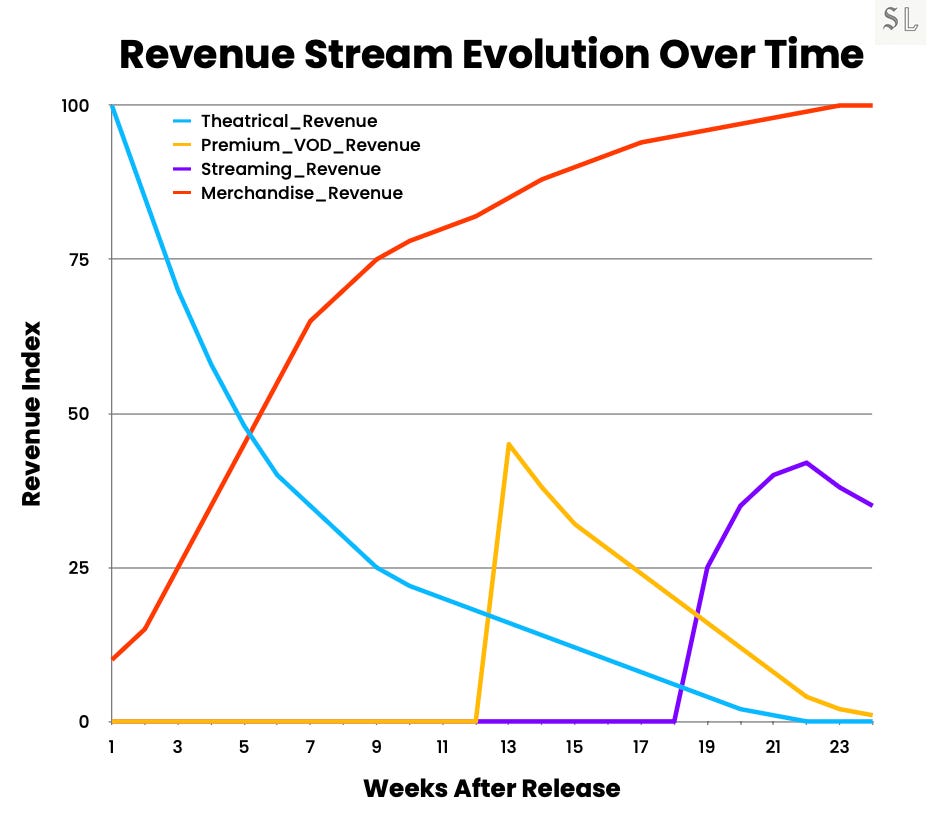

Cinema is the upstream trigger, not the end state. Barbie proves it: +27% YoY doll sales; merch overtakes theatrical within 10–12 weeks while streaming supplements. Theatrical-first franchises dominate licensing and fan economies versus streaming-first IP. The Times’ forward look—another crowded franchise summer in 2026—suggests studios will keep pressing the button. My point is how: treat theatrical as ignition protocol and brand R&D for the flywheel, not as a weekend scoreboard.

What My Model Already Predicted

The logo glut without a cultural “hook” produces soft peaks.

My Ignition frame predicted this: when titles lean on familiarity without a remixable, one-second-legible, emotionally sticky hook, they land in Collapse/Churn instead of Ignition. Result: no ignition, no seasonal lift.

Right-sized franchise returns beat over-capitalised sameness.

The operating rule is shape beats size: re-route 15% of legacy media into creator-native and live-signal tactics (documented +4–6× ROI), then let premium/eventisation do the yield work. In practice: right-size later-stage IP, sell a clear, legible proposition, and use premium formats and event nights to concentrate demand rather than inflate spend. The NYT’s case notes back this: Fantastic Four worked on a modest, workable scale, and the Lilo & Stitch revival landed because the proposition was clear and desire was banked, not because budgets were maximal. Taste beats tonnage.

Platform eclipses distort everything else.

GTA VI isn’t a “competing title” but a cultural eclipse. I’ve shown why: 475M trailer views in 24 hours, an $8B franchise backbone, 210M+ copies for GTA V, ARPU ~$70–$300+, 30–1,000+ hours of dwell time, and a decade-plus cultural half-life versus film’s ~3 hours and weeks-long tail.

In that gravity well, release-date logic breaks: the feed, the mood, and the scroll all bend toward the event. The NYT already points to a crowded IP calendar in 2026. Plan as if eclipses are fixtures, not surprises and LOOK BEYOND THE FILM RELEASE SCHEDULE!

Where I’m Updating My Thinking

I under-weighted slate shape and supply risk.

My core theses centred around system dynamics (feeds, flattening, ritual), all still accurate. But this new data from the NYT surfaces a portfolio maths issue that wasn’t available before: a summer that delivered only two $300m domestic weeks where 2019 had nine, and a top-five stack of $1.6bn vs $2.6bn in 2019. These are classic signs of too few four-quadrant ignition moments and weak week-by-week spacing. I’m adding calendar physics to my framework: Peak-Week Density (how many weeks my slate can plausibly clear the $300m bar) and Adjacency Risk (the penalty when like-for-like titles bunch and cannibalise attention). These sit on top of my existing mechanics: signal over schedule (discovery is platform-native, not calendar-led) and win Friday, win the P&L. So dating and spend are optimised at the slate level, not just the title level.

Europe’s resilience ≠ immunity.

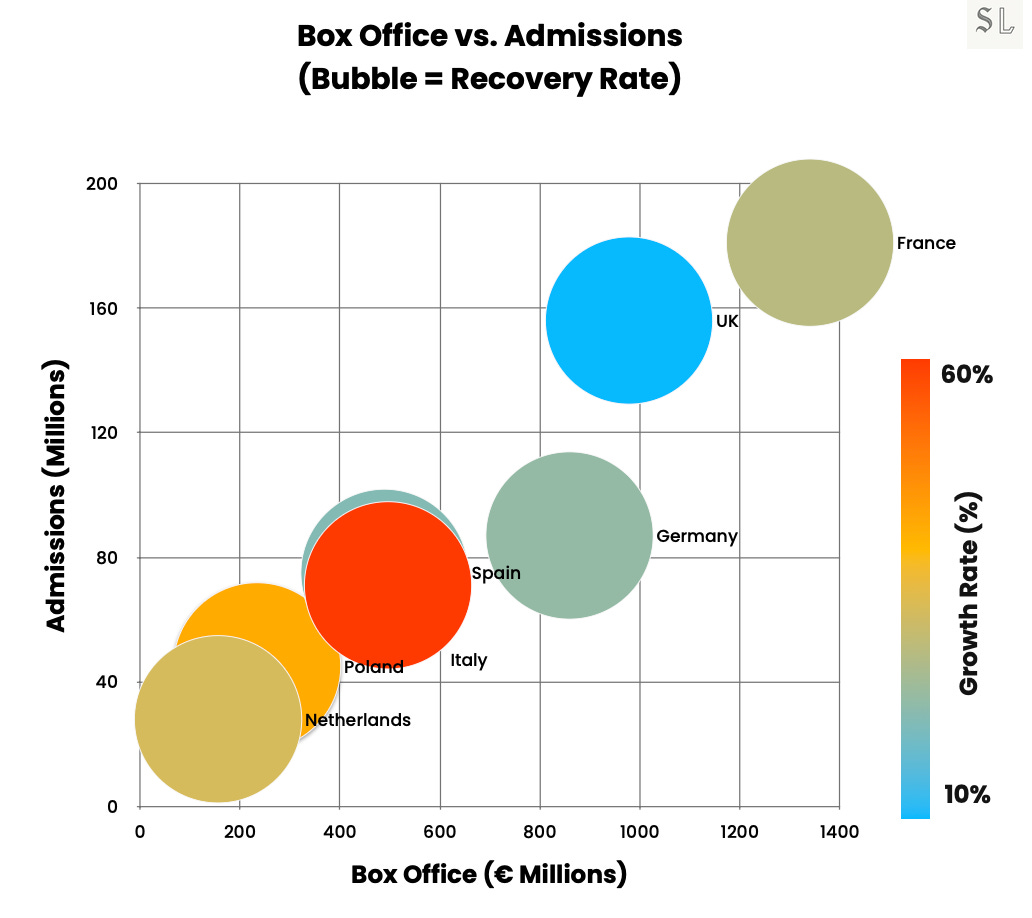

I’ve argued (and shown) that Europe’s rebound is real and durable (975.5m admissions and €7.2bn in box office, with France and the UK already near pre-Covid scale).

That’s structural format resilience: cinema as a durable container for attention. But the NYT’s North America slump proves resilience doesn’t prevent seasonal failure when the slate is thin. So I’d make this far clearer: resilience is the floor; slate creates the ceiling, and that ceiling depends on peak-week density and adjacency risk management.

AI isn’t the enemy of cinema, but it is the enemy of reliable attention.

My talks already show the flood (34M+ new AI media assets/day, 3.5B AI-assisted Shorts/month, and 68% of Gen Z saying they can’t tell if content is AI-made — nor do they care!!). Platforms are doubling down with auto-dubbing and lip-sync localisation that expand creator reach at near-zero cost.

That doesn’t “kill film”; it compresses awareness half-lives and makes mass-reach marketing decay faster unless countered by ritual and legible novelty (Ignition criteria: one-second read, emotional hook, remixability). I’m going deeper on this model accordingly: treat AI as an attention-decay multiplier in planning, and hedge it with Friday-night eventisation and premium mix. This reframing also maps to the NYT’s diagnosis: concentrating attention is getting harder; the fix is designing for ignition and moments, not shouting louder on the wrong timeline.

Taste/curation needs an operating rule, not a vibe.

I’ve argued that taste is scarcity and pointed to A24/MUBI-style trust that stands. But the NYT’s franchise under-performance means I need to codify it. No one needs another acronym, but if I had to create one, I’d focus on Minimum Viable Novelty (MVN): a pass/fail gate before we lock media. MVN = one-second legibility + an emotionally sticky idea + organic remixability. Diagnostics: pre-release evidence of early-fandom lift in Discord/Letterboxd/Reddit, platform-native UGC prototypes, and an improving viral coefficient on TikTok/Discord (engagement × virality). If a title fails MVN, we right-size capex or reposition; if it passes, we bias spend toward creator-native + live-signal tactics and let PLF/eventisation do the yield work. This turns “curation” from aesthetic plea into a measurable greenlight bar.

Okay, fine. New Metrics To Move Our Debate Forward

Peak-Week Mechanics.

Define Peak-Week Velocity (PWV) as the lift required to clear the $300m in-season domestic week. Benchmark: this summer delivered two PWVs where 2019 had nine: the signature of a slate short on engineered spikes. The levers already exist in my framework: Ignition (MVN: one-second legibility, emotional hook, remixability) to concentrate demand; eventisation/Friday-first dating to pull it into decision windows; and PLF mix to raise yield per show (<15% of showtimes → >45% of revenue), with operational moves like converting ~2% of weekly shows to premium and locking event nights. Practically: plan the slate for PWV capacity: map target weeks, de-conflict adjacency, and instrument ignition + PLF against those specific weeks

Franchise Half-Life

Define a Sequel Degradation Index (SDI): the delta in performance versus the prior instalment after normalising for (i) budget/media weight, (ii) release windowing (PVOD/streaming timing), (iii) rating/age certificate, and (iv) adjacency (like-for-like competitors in-week). The NYT’s finding that more than half of sequels trailed their previous entries is the empirical spark for SDI; it quantifies when familiarity has slid into indifference rather than resonance. Mechanism: in my Ignition model, titles without one-second legibility + emotional hook + remixability fall into Collapse/Churn. Operating rule: if SDI < 0 ex-ante (forward model) or across two consecutive entries ex-post, you right-size capex, reposition dating, or demand MVN before locking spend.

Right-Sizing Budgets by IP Maturity

Codify a Workable Scale Rule: late-stage or tarnished IP has to earn back trust before it earns back budget: operate at lower capex, with a sharper creative hook, and only scale once it passes MVN (one-second legibility, emotional hook, remixability). The NYT case notes point the way: Fantastic Four worked at a modest, workable scale, and Lilo & Stitch landed because the proposition was clear and desire was banked, not because spend was maximal. Link this to my shape beats size reallocation: re-route ~15% of legacy media into creator-native + live-signal tactics (+4–6× ROI) and let premium/eventisation concentrate yield, rather than buying blunt reach. If a title fails MVN or shows a negative SDI trend, right-size or reposition before locking media. Clarity first, scale second.

Summer didn’t fail for lack of demand

Summer failed for lack of novelty and slate design. Pre-sold IP is now a tax unless it clears Minimum Viable Novelty (one-second legibility, an emotional hook, real remixability). What will be most interesting is to see the longer tail of these summer releases. As proven, we need to treat cinema as the upstream ignition protocol: it lights the flywheel while streaming monetises the wake (see Barbie).

The problem and the solution are both operational

Summer didn’t collapse because audiences disappeared or hate going to cinemas. It collapsed because the releases relied too heavily on familiarity for novelty, and logos for traction.

The fix isn’t nostalgia, or another round of obituary headlines. It’s operational: build Peak-Week Velocity into your slate on purpose. Force every title through the Minimum Viable Novelty test. Track the Sequel Degradation Index before you burn nine figures on inertia. Map an Eclipse Calendar so you don’t launch into cultural black holes you can’t win. And treat PLF and eventisation as central to revenue.

I’ve said it 100x and I’ll say it 100x more: cinema is still one of the only format that converts attention into memory, memory into momentum, and momentum into money.

If you’re around and in LA this next week, say hi. If you’re around and in Miami or NYC the week after, say hi, too.