Pedigree Won’t Save You: Feeds Are the First Window

A billion people now watch podcasts on TV each month. Welcome to even more competition.

Guys, it’s getting busy. We’re hosting an invite-only EOY predictions lunch at Hotel Cafe Royal in London on 20 November. If you want to be added to the interest list, send a message.

If you’re at Content London in December, so am I. I’ll be chatting away and giving the opening talk.

And finally, what’s that you say, Thailand in December? Why yes. I’ll be giving the CineAsia keynote address in Bangkok.

Three numbers: 31%, 1 billion, ~400 million.

That’s YouTube as the most-used podcast service in the U.S., a billion people watching podcasts there each month, and roughly four hundred million hours watched on living-room TVs. The podcast category has moved from earbuds to sofa.

As I’ve said (at length), the first window for TV behaviour is the feed. Long before this week’s headlines, I predicted podcasts cutting the cord from audio and turning into video-first shows. Congratulations: it happened. The TV’s home feed is now the channel guide.

And with that, the competition not only expands but resets. On the TV home screen, creators, athletes, comedians, journalists and niche experts are all in the same weight class. Content is priced by click, hold, return, not by pedigree as default. When the algorithm is the scheduler and the session starts in a feed, pedigree is just set dressing.

But sure, perhaps television will be different. Bless.

Today We’re Talking About

The feed is the first window. The TV home feed is the new channel guide. Your app/FAST is repeat-behaviour infrastructure.

YouTube is the network. 31% / 1B / ~400M CTV hours. “Video podcasts” aren’t sneaking onto TV, they are TV.

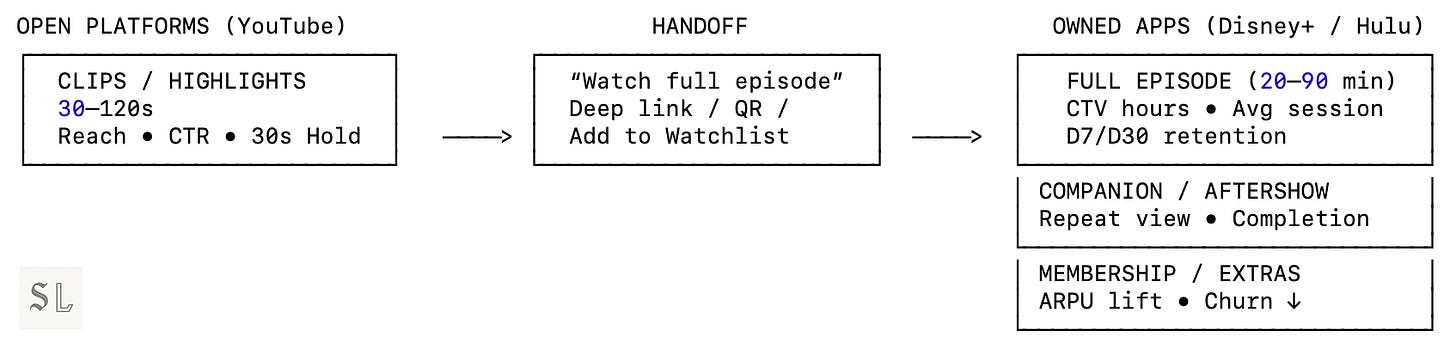

Disney’s split. Lure on open, glue on owned: YouTube acquires, Disney+/Hulu retains. Buy fans with the feed and keep them with the tile.

Spotify × Netflix. “Clip to full” is now paperwork.

Competition reset. On the home screen, creators and legacy TV share a ring. Click / hold / return beats pedigree.

Four rules of the feed. Incentives bend creativity, metrics beat awards, pipes take the rent. Only owned audiences hedge the algorithm.

The Sameness Tax. Optimise long enough and everything rhymes: buy stakes/reveals/field/live, not neon and ferns.

Platform trap. First they subsidise, then centralise, then squeeze. You’re building on someone else’s rails. Hedge before the squeeze.

Stakes for owners. Commission for sessions you can hold (CTV hours, avg session, D7/D30), not for tasteful pilots.

🔐 Subscribers Only Operator’s Manual 🔐: coexistence-first playbook, two-minute YouTube give-up check, and the KPI dashboard that actually runs the lane.

Behind the Headlines You Probably Saw

Reality check: viewers start on the home feed on their TV (usually YouTube, sometimes TikTok), not in your app. That feed is the new channel guide.

YouTube became the network.

It’s the most-used podcast service now (sorry, Spotify). About a billion people watch podcasts there each month, and hundreds of millions of those hours happen on living-room TVs. This isn’t by accident: YouTube paid to make this happen. Translation: “video podcasts” aren’t sneaking onto television, they are television. Discovery and habit begin in the feed, not on your channel.

Disney showed the split: lure on open, glue on owned.

Companion shows launch on YouTube to harvest reach, then live inside Disney+/Hulu to deepen sessions. This is the new distribution funnel:

Spotify and Netflix turned intuition into paperwork.

Okay, we get it now: clips go to YouTube and full episodes live behind tiles (ad-free on Netflix; ad-supported on Spotify Video). The clip-to-full path isn’t marketing anymore but papered distribution. Windowing now formalises what audiences were already doing: start in the feed, finish on the platform.

(And just to remind everyone of an important nuance so none of us are surprised: formalising other formats normalises other formats.)

Net effect: Your app isn’t the first window, it’s where repeat behaviour lives. And the uncomfortable coda: pedigree won’t save you.

Four Rules of the Feed

You’ve seen this film. When feeds replace curators/editors/commissioners/fill in the blank-ers, the market stops rewarding pedigree and starts paying for immediate response. Same engine, new screen.

A Short, Depressing History

Newspapers to social/SEO feeds: front pages gave way to algorithms. We got pivot-to-video, listicle mills, headline A/B farms, and hollowed-out local news.

Music to playlists/TikTok: radio gatekeepers ceded to playlists and For You pages. We got hooks by ten seconds, singles over albums, playlist politics, meme-chasing A&R.

Retail to Amazon/Temu search: buyers and endcaps lost to ranked results. We got ad-taxed shelves, review-gaming, copycat SKUs, margin drifting to the pipe.

Apps/games to app-store/UA feeds: Editor’s Choice lost to paid installs. We got hyper-casual churn, ad-monetised loops, budgets flowing to arbitrage over craft.

Publishing/blogs to aggregators/trending tabs: homepages gave way to “What’s Trending”. We got SEO factories and creator newsletters became the sovereignty hedge.

Why the outcomes rhyme (and why TV isn’t special):

Incentives bend creativity. When the payout is click, stay, come back, the work reshapes to fit it: sharp cold opens, clipped act breaks, visible reactions, tease-then-payoff. Editorial judgement doesn’t vanish, per se, but routes through response curves. If the model can’t see it, the audience won’t either.

Metrics beat awards. Awards and tasteful pilots are lovely. But the feed cares about watch-time, session length, repeat rate. Credits don’t beat that. If the first 15 seconds are mush, there won’t be a second date.

Pipes capture the rent. Distribution is a business, not a favour. As categories mature, “organic” declines, ad taxes rise, terms change, and margin migrates to the pipe owner. The landlord always gets a pay rise. (Anyone still dealing with building your entire “DTC” streaming business on the back of Amazon/Apple Channels?)

Only owned audience hedges the algorithm. You can’t stop platform gravity. Turns out you can only counterweight it. Capture an ID (email, membership, IRL), build rituals off-platform, and keep the relationship portable. Rented reach is a guaranty (you can’t market yourself out of technofeudalism - it’s a thing), so owned demand is what matters.

The Sameness Tax (feeds flatten culture)

If the feed is the first window, it’s also the chief stylist. When discovery lives in a home feed, everyone learns to beg the same way. So you get your lovely “data people” in the room to optimise. Problem is, optimise long enough and everything flattens.

The aesthetic, singular. Take podcasts: Two mics, neon sign, mid-shot, polite nod on the laugh line. Efficient? Yes. Memorable? Only to the person who bought the neon.

Flattening physics. What gets measured gets engineered. Click-through trains the same cold opens. Retention carves out the same act breaks. Thumbnails herd you into the same face. Result: form converges.

What still reads as TV (survives compression). Stakes, reveals, field moments, on-screen receipts, live jeopardy. Everything else is set dressing with better ferns. (Speaking of ferns, this was great.)

Translation: stop buying the neon sign; buy the moments the model can’t counterfeit.

You’re Building a Business on Someone Else’s Rails. Again.

The platform playbook is boringly reliable: first they subsidise, then they centralise, then they squeeze (this is what we call enshittification). Lovely to users, generous to businesses, and then they charge both. All of the internet today: that’s enshittification you feel (why everything sucks) and chokepoint capitalism as the engine underneath (own the gate, charge rent to pass through it).

Another short, depressing recent history of enshittification and chokepoint capitalism

Facebook and publishers.

What happened: Facebook hosted articles inside its app (Instant Articles) and told publishers video was the future (“pivot to video”). Then the ranking formula changed.

Why it matters: traffic and ad revenue vanished almost overnight because distribution was never yours but rented from an algorithm.

YouTube and creators.

What happened: monetisation was granted, then withdrawn, then returned under stricter “brand-safe” rules; new thresholds appeared; Shorts was pushed and somehow external links became harder to use.

Why it matters: creator income depends on policy toggles, not just performance. One change to suitability rules or format priorities can halve revenue.

Spotify and audio.

What happened: Spotify wrote cheques for podcast exclusives to build catalogue and habit. Later, house priorities shifted, rules shifted and music economics reasserted themselves and podcasts became the rent payer.

Why it matters: when the bundle reprices, your show is a line item, not an asset. Distribution remains the chokepoint.

Amazon and retail.

What happened: the Buy Box increasingly functions like paid shelf space. To be found, sellers buy ads.

Why it matters: “discovery” is now an advertising bill. Margin migrates from brands to the pipe owner.

App stores and everyone.

What happened: the 30% platform cut stayed; rules kept changing and Apple’s privacy reset (ATT) blew up user-acquisition playbooks.

Why it matters: the store owns the doorway and charges a toll. “Organic” discovery is mostly myth or pay-to-surface.

Reddit/Twitter (X) and developers/media.

What happened: API access moved behind hefty fees. Third-party clients withered and visibility increasingly comes via paid promotion.

Why it matters: the civic square became a shopfront you pay to stand in, with the landlord setting the rent.

TikTok/Instagram and link-outs.

What happened: external links lost prominence while in-app Shops were elevated. The apps keep you inside and monetise the session.

Why it matters: referral traffic drains and commerce shifts to the platform’s checkout, where it takes a cut.

Twitch and streamers.

What happened: revenue shares drifted down and rules around simulcasting wobbled. Policy changed the economics of going multi-platform.

Why it matters: the moat belongs to the moat-owner. Your audience may love you but your platform loves its margin more.

Moral: discovery lives in the feed and leverage doesn’t.

But sure, TV will be different.

Before the 🔐: what this means for content owners

Discovery is solved elsewhere. The TV home feed is the first window. Your app/FAST is the repeat-behaviour window. Treat it like habit infrastructure, not a billboard.

Price outcomes, not pedigree. You are buying sessions you can hold. The scoreboard: CTV hours, average session, D7/D30 return, not downloads, not tasteful pilots.

The new greenlight. It’s not “do we like it?” It’s “does it move from clip to couch, and does it come back next week?” If no, that’s marketing spend, not programming.

Mind the rails. You are building on someone else’s feed. The cycle is dependable: first they subsidise, then they centralise, then they squeeze. Hedge before the squeeze.

Subscribers: below the line you’ll get the commissioning/windowing playbook (that won’t make Legal cry), a two-minute YouTube give-up sanity check, and the KPIs that matter.